Scottish Widows has found that only seven per cent of consumers have consulted a financial adviser about their personal finances.

The finding was part of the firm's seventh annual Savings and Investment report. Scottish Widows is a corporate member of the Institute of Financial Planning.

Direct internet purchases and via comparison sites were the most common methods of purchasing an investment although 34 per cent said they went to their providers' branch to invest.

The report read: "Respondents appear to be unwilling or unable to access the type of holistic financial advice that might assist them to construct a potentially higher returning, more diversified and tax effective portfolio.

{desktop}{/desktop}{mobile}{/mobile}

"This could be because advice is not considered affordable, it is not readily available or represents a shift in the way that investors purchase products."

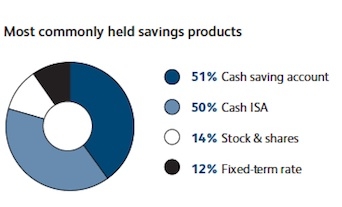

Regarding investments, over half of respondents had a cash saving account, 50 per cent had a cash Isa but only 14 per cent had a stocks and shares Isa. When broken down by age, 20 per cent of people over 50 had a stocks and shares Isa but only six per cent of those aged 18-34.

While they may own an Isa, a third of people said they did not have enough money to full their Isa limit.

They were also less aware of risks with 47 per cent of people saying they would give up the potential of higher returns for the certainty that their investment would fall.

The report highlighted that: "While direct experience of stocks and shares Isa is lower at younger ages, the extent of this difference reinforced the need for practical financial education for younger adults."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.