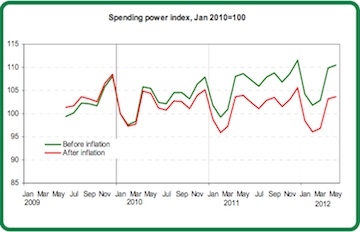

Households are £34 a month worse off than a year ago as inflation remains high and spending growth weak, according to Lloyds TSB.

The latest Lloyds TSB Spending Power report found that some 83 per cent of people said they had noticed the costs of essential spending increase over the past year and 79 per cent said inflation was ‘not good’ or ‘not good at all’ despite inflation falling over the past few months.

Those aged 35-54 were most likely to say they do not have enough money to meet monthly outgoings with 63 per cent of people spending at least 75 per cent of their monthly income on household bills and essentials.

Future forecasts were similarly negative with more respondents feeling they would have to less to spend in six months time than they do now.

However, those who did have spare money at the end of the month said they were more likely to save it due to the need for financial security.

Patrick Foley, chief economist at Lloyds TSB, said: “Weak income growth and stubbornly high inflation is ensuring the squeeze on consumers is remaining in place longer than many thought it would.

“Growth in spending on essentials is now showing signs of moderating which is positive but the weakness in income growth is severely limiting the benefits for consumers.”