The rising cost of living remains the second-most important issue facing UK consumers, according to Britons asked by the Office for National Statistics for its latest Public Opinions and Social Trends survey.

Some 88% of adults mentioned the cost of living as a key issue for them, just below the NHS at 89%.

The economy remained the third most reported issue at 68%, followed by housing (60%), crime (59%), climate change and the environment (58%).

The study was conducted after last month’s election on 4 July and threw up a variety of new statistics about people's concerns about the cost of living.

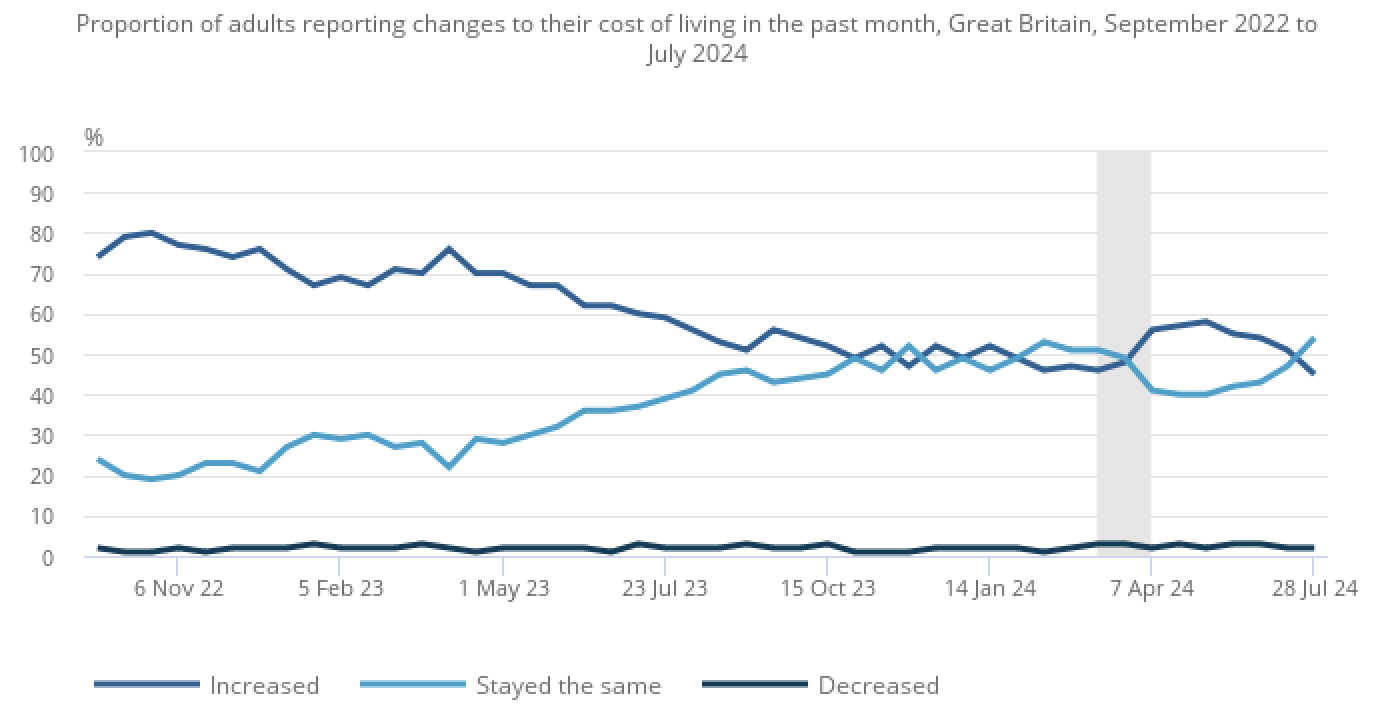

Just over half (54%) of adults reported their cost of living had stayed the same in the past month while 45% said that it had increased.

More than six in ten (64%) adults continued to say they would be able to pay an unexpected but necessary expense of £850. A quarter of adults (25%) believed they would be unable to pay such an expense.

Source: Opinions and Lifestyle Survey from the Office for National Statistics

The ONS also examined people’s expectations of their household income before the election in May which showed that around one in eight (13%) adults strongly disagreed or disagreed that their household income covers their minimum basic living needs.

The proportion was higher for unemployed adults (31%), those living in rented accommodation (25%), adults who were economically inactive but not retired (24%), disabled adults (21%) and those living in the most deprived areas in England (21%).

Around seven in 10 (69%) adults agreed, or strongly agreed, that their household income did cover their minimum basic living expenses, and 18% neither agreed nor disagreed.

Around three in 10 (29%) adults believed that their household income would rise in the next 12 months, with men (32%) more likely to say this than women (26%). Around half (48%) of adults expected it would stay the same, and around one in ten (11%) expected it would decrease.

• Analysis based on adults aged 16 years and over in Great Britain. Data referring to the "latest period" are based on 1,841 responding adults for the period 5 to 28 July. Expectations of household income data is based on the period 13 March to 19 May comprising responses from 12,437 adults collected during five waves of data collection in the period.