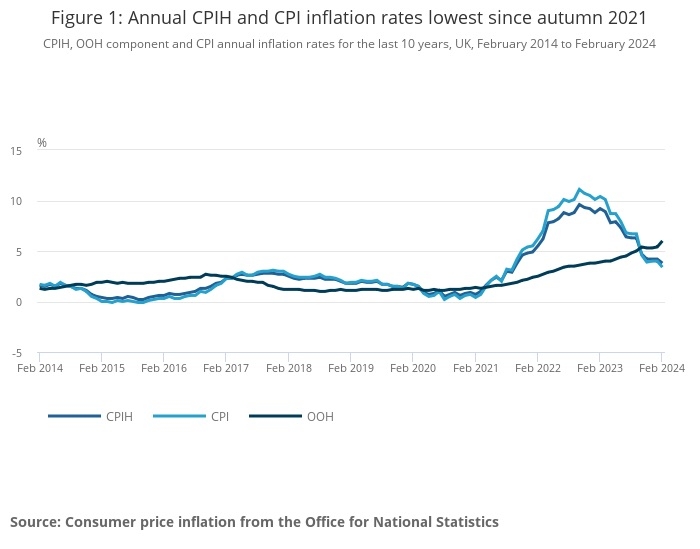

CPI inflation, the main measure of inflation, dropped sharply in February to 3.4% from 4% in January, ONS said today.

Falls in food prices were the biggest factor in the fall, news which will cheer many stretched households.

Inflation is now at its lowest level for 30 months.

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 3.8% in the 12 months to February 2024, down from 4.2% in January.On a monthly basis, CPIH rose by 0.6% in February 2024, compared with a rise of 1.0% in February 2023.

On a monthly basis, CPI rose by 0.6% in February 2024, compared with a rise of 1.1% in February 2023.

ONS said the older measure of inflation, RPI, fell from 4.9% to 4.5% between January and February.

ONS said the biggest downward contributions to the monthly change in both CPIH and CPI annual rates came from food, and restaurants and cafes, while the largest upward contributions came from housing and household services, and motor fuels.

Core CPIH (excluding energy, food, alcohol and tobacco) rose by 4.8% in the 12 months to February 2024, down from 5.1% in January; the CPIH goods annual rate slowed from 1.8% to 1.1%, while the CPIH services annual rate eased slightly from 6.1% to 6.0%.

Core CPI (excluding energy, food, alcohol and tobacco) rose by 4.5% in the 12 months to February 2024, down from 5.1% in January; the CPI goods annual rate slowed from 1.8% to 1.1%, while the CPI services annual rate eased from 6.5% to 6.1%.

However, in bad news for home buyers the owner occupiers' housing costs (OOH) component of CPIH rose by 6.0% in the 12 months to February 2024, up from 5.4% in January. This is the highest annual rate since July 1992. OOH costs rose by 0.9% on the month compared with a 0.3% increase between January and February 2023.

Tom Stevenson, investment director at Fidelity, said the CPI fall was significant.

He said: "The significant - and slightly bigger than forecast - fall in inflation from 4% to 3.4% in February was expected and welcome. It provides a helpful backdrop to tomorrow’s rate-setting decision by the Bank of England. Inflation is likely to continue dropping through the spring as cheaper gas and electricity from April drives household energy costs lower. The key unanswered question is whether, and by how much, price growth bounces back from target in the second half of the year - the Bank’s central expectation.

"Cheaper food was the biggest downward contributor to the February inflation rate, while housing costs and fuel provided some upward pressure. The UK has been an outlier, as inflation has fallen back more slowly than our peers. But the latest data shows us falling back in line with the US and Europe. It provides substance to the government’s claim, at the Budget and elsewhere, that the UK economy has turned the corner."

Lindsay James, investment strategist at Quilter Investors, said inflation looked to be coming back under control.

She said: “With the majority of divisions seeing reduced levels of annual inflation in February, with areas such as food and communication seeing notable falls, the data paints a picture of broad disinflation across the goods economy, with the services sector seeing a much more muted drop. The plunge in energy bills anticipated in April could see an even greater fall in headline figures, aligning with the Office for Budget Responsibility’s expectation that inflation will average out at 2.2% in 2024.

"However, economist forecasts for the medium term have considerable variance, highlighting risks that are still present around energy security, supply chain resilience and structural labour shortages."

“Wage growth has been a significant driver of inflation in the service economy for some months, and recent data showed this is now slowing a little. However, it will likely make the Bank’s 2% target more difficult to achieve."