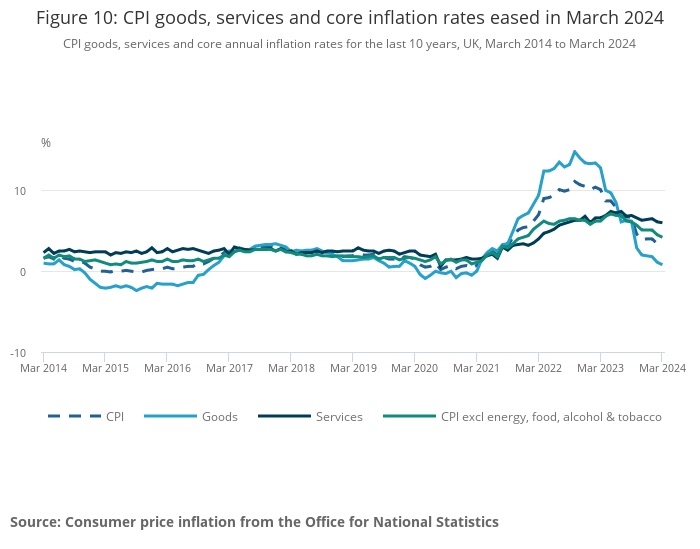

CPI inflation fell from 3.4% in February to 3.2% in March, its lowest level for two and a half years, according to ONS figures published today.

Falls in food prices were the biggest factor in the fall, news which will cheer many stretched households.

Food inflation fell to 4%, in comparison to 19.2% in March 2023.

However, Grant Fitzner, chief economist for the ONS, said lower food costs were partially offset by rising fuel prices.

Chancellor Jeremy Hunt said that people should start to feel the difference of lower inflation.

CPI inflation dropped sharply in February to 3.4% from 4% in January.

Inflation has been slowly falling since it peaked in late 2022.

RPI inflation, the older measure of inflation, fell from 4.5% in February to 4.3% in March.

Sarah Coles, head of personal finance at Hargreaves Lansdown, said today’s ONS figures would be welcome news for savers.

She said: “With inflation at 3.2%, there are savings and cash ISA rates which beat inflation in every market – from easy-access to the longest fixed rate savings deals. There are still easy-access accounts and shorter-term fixed rates offering more than 5% - so they can beat it by a decent margin.

“Easy-access rates have been particularly strong in 2024, despite having softened in March, with the top of the market falling 10 basis points. Meanwhile, one-year fixed rates stayed relatively steady in March, and we’ve actually seen two-year fixed rates rising.

“These deals aren’t going to last forever. As inflation comes under control, banks will price in more rate cuts, and savings deals will drop. Over the past quarter, we’ve already seen savings rates fall across the board, with the largest declines occurring in the fixed term deposit space.”

Danni Hewson, head of financial analysis at AJ Bell, warned that despite the positive news there were still some troubling figures in today’s ONS report.

She said: “Inflation is moving in the right direction and anyone who has wheeled a trolley around a supermarket over the past few weeks will have noticed that prices aren’t delivering those checkout shocks in the same way they were this time last year.

“Next month should look even better as the falling energy price cap is finally counted in the numbers, even if many households won’t have noticed much difference to their outgoings as their direct debits remain elevated to pay off outstanding balances.

“But even in this set of figures there are a few troubling issues, notably the stickiness of service sector inflation. This could be exacerbated by the increase in the National Living Wage which is putting pressure on many businesses to hike prices again to balance their books.”

Rob Clarry, investment strategist at Evelyn Partners, agreed that the Bank of England will want to see a drop in service sector inflation before committing to cutting the base rate.

He said: “The services component of CPI inflation remains elevated at an annual 6%, which was above the 5.8% expected – and the Bank of England will want to see more progress on this measure before they commit to a rate cutting cycle.

“Despite softer domestic conditions, the Bank’s monetary policy committee will be wary about cutting in the face of higher US interest rates. As a smaller but open economy, the UK is exposed broader global economic forces, and this has been on display in recent weeks as US bonds yields have risen amidst sticky inflation, which has placed upward pressure on UK government bond yields.

“Cutting interest rates in this environment would likely lead to sterling deprecation, which would, in turn, lead to higher import prices and put upward pressure on UK inflation. As we enter the summer months, the Bank will continue to face a difficult balancing act between growth on one side and inflation on the other.”

He added that Evelyn Partners does not expect to see a base rate cut until the second half of this year.