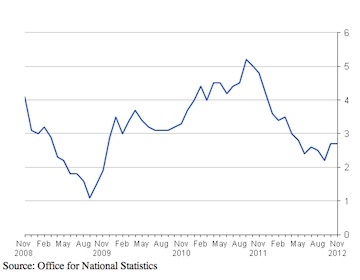

Consumer price index inflation remained at 2.7 per cent in November, unchanged from October.

Retail price index inflation fell from 3.1 per cent to 2.9 per cent.

The Office for National Statistics said that although the rate was unchanged, there had been more significant upward and downward pressures compared to October.

Largest upward pressures came from food and non-alcoholic beverages which rose by 1.1 per cent and housing and household services which rose by 0.6 per cent, particularly domestic gas and electricity.

{desktop}{/desktop}{mobile}{/mobile}

Largest downward pressures came from motor fuels which fell by 1.0 per cent and furniture, household equipment and maintenance which fell by 0.1 per cent.

Largest downward pressures for RPI came from motoring expenditure, housing and household goods which were offset by a upward pressures from food.

The ONS also announced changes it would be making to the CPI readings from March 2013. This will see owner occupiers' housing costs included in the CPI reading, creating a new index called CPIH. These will measure housing costs using a rental equivalence methods which will show the costs of owning, living in and maintaining a property.

The next reading will be taken on 15 January 2013.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.