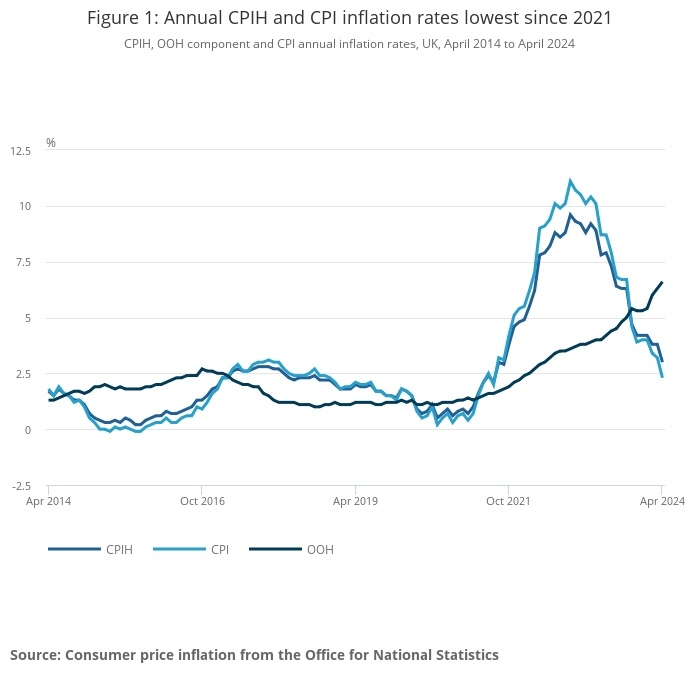

CPI inflation in April fell to 2.3%, down sharply from 3.2% in March, ONS reported today.

The fall pushes inflation down to its lowest level for three years and brings the Bank of England much closer to its 2% target.

In October 2022 inflation spiked to 11.1%, the highest level for four decades.

The drop in April may pave the way for interest rate cuts later in the year, according to some experts.

Falling gas and electric prices were among the biggest downward factors in April.

The Consumer Prices Index (CPI) rose by 2.3% in the 12 months to April 2024, down from 3.2% in the 12 months to March.

On a monthly basis, CPI rose by 0.3% in April 2024, compared with a rise of 1.2% in April 2023.

The older RPI measure of inflation, still widely used, fell from 4.3% in March to 3.3% in April.

ONS said that falling gas and electricity prices resulted in the largest downward contributions to the monthly change in both CPIH and CPI annual rates, while the largest, partially offsetting, upward contribution came from motor fuels, with prices rising this year but falling a year ago.

While CPI inflation was down there was less positive news for home owners whose cost rose 3% in the 12 months to April, however this was down from 3.8% in the 12 months to March.

On a monthly basis, CPIH (CPI including housing costs) rose by 0.5% in April 2024, compared with a rise of 1.2% in April 2023. Core CPIH (excluding energy, food, alcohol and tobacco) rose by 4.4% in the 12 months to April 2024, down from 4.7% in March. The CPIH goods annual rate slowed from 0.9% to negative 0.8%, while the CPIH services annual rate was unchanged at 6.0%.

Core CPI (excluding energy, food, alcohol and tobacco) rose by 3.9% in the 12 months to April 2024, down from 4.2% in March; the CPI goods annual rate slowed from 0.8% to negative 0.8%, while the CPI services annual rate eased slightly, from 6.0% to 5.9%.

ONS Chief Economist Grant Fitzner said: “There was another large fall in annual inflation led by lower electricity and gas prices, due to the reduction in the Ofgem energy price cap.

“Tobacco prices also helped pull down the rate, with no duty changes announced in the budget. Meanwhile food price inflation saw further falls over the year. These falls were partially offset by a small uptick in petrol prices.

“The prices of goods leaving factories have risen a little over the last year. Meanwhile, the prices of raw materials and fuels grew in the last month, though they remain below where they were a year ago.”

Industry reaction to the fall was positive.

Jonny Black, Chief Commercial & Strategy Officer at Abrdn adviser, said: “As we inch closer to the Bank of England’s 2% target, speculation over its next interest rate decision is set to intensify. It is now not a case of if rates will be cut, but when.”

Steven Cameron, pensions director at Aegon, said: “The latest drop in the inflation rate to 2.3% will be widely welcomed as a sign that price inflation is finally getting back under control, helping alleviate the cost-of-living crisis and hopefully paving the way to future falls in interest and mortgage rates.

“It’s also significant for the State Pension Triple Lock, which grants State Pensioners an annual increase equal to the highest of price inflation, earnings growth or a minimum rate of 2.5%.

“For the April 2024 increase, earnings growth in 2023 produced an inflation-busting 8.5% increase. In April 2023, a spike in inflation the previous year led to a record-breaking 10.1% boost to the State Pension. These increases and the underlying high volatility that was present in both price inflation and earnings growth, have since raised serious questions over longer term affordability of the State Pension, which is paid for by today’s workers.

“With inflation having now fallen below the 2.5% underpin, it’s likely to be earnings growth that determines next year’s Triple Lock increase, as the latest figures have this sitting at 5.7% (for January to March 2024). The specific figure used for determining the Triple Lock will be the year-on-year increase in earnings for the period ending May to July 2024, which will be published in September. Barring a significant drop in earnings growth over the next few months, this figure will likely determine next year’s Triple Lock.

“If price inflation stays low and earnings growth also gradually falls back to levels more typical of the last decade, then the State Pension Triple Lock formula may produce more predictable and affordable increases. This will make it less costly for the next Government to commit to maintain it for a further 5 years. We may see lower rates of increases, but in times of lower inflation, the State Pension doesn’t need to increase by as much to allow pensioners to maintain living standards."

Daniel Casali, chief investment strategist at wealth manager and Financial Planner Evelyn Partners, said: “While the inflation data surprised on the upside, the broad downward trend in inflation is intact. This raises the possibility that the Bank of England (BoE) could still cut its base interest rate at its next interest-rate setting meeting in June. Though this is now a tight call.

“In the data, the large leg down in inflation came from a 12% fall in the dual-fuel Ofgem price cap on household energy bills. Given that the energy price cap happens every three months, the next change would not be until July. However, Ofgem would probably make an official announcement in a couple of weeks to warn of an upcoming change. Based on current market prices, Barclays reckons that the energy cap could be reduced by a further 6-7% points. If realised, this would imply further downward pressure on the household energy part of CPI inflation.”

Danny Vassiliades, partner at XPS Pensions Group, said: “All eyes are now turning to the potential timescale of interest rate cuts, with hopes buoyed by the deputy governor of the Bank of England’s comments that summer cuts are “possible.”

“Falling inflation represents good news for many private sector defined benefit members who have recently experienced inflation above their maximum guaranteed pension increases for the first time in decades. With the lowest such guarantees typically around 2.5%, defined benefit pensioners will be hoping that inflation remains at its current levels to protect against a repeat of the real income cuts they have experienced over the last two years.”