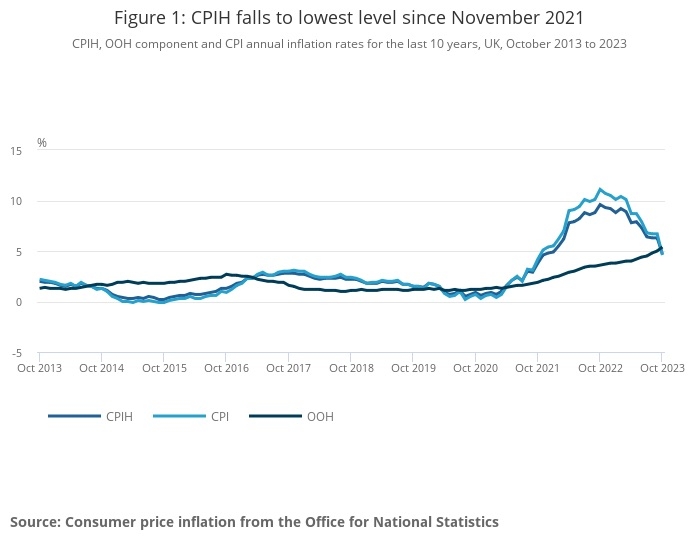

CPI inflation in the 12 months to October fell to 4.6%, a significant drop on the 6.7% rate in September.

CPI has now more than halved from the 10.1% rate see in March.

The wider CPIH measure (Consumer Prices Index including owner occupiers' housing costs) rose by 4.7% in the 12 months to October 2023, down from 6.3% in September.

On a monthly basis, CPI did not change in October, compared with a rise of 2% in October 2022.

The drops were welcomed by experts, with some reservations.

ONS said that the biggest downward contribution to the monthly changes in CPIH and CPI annual rates came from housing and household services, where the annual rate for CPI was the lowest since records began in January 1950.

The second-largest downward contribution to the monthly change in CPIH and CPI annual rates came from food and non-alcoholic beverages where the annual rate was the lowest since June 2022, although food inflation remains over 10%.

Core CPIH (excluding energy, food, alcohol and tobacco) rose by 5.6% in the 12 months to October 2023, down from 5.9% in September. The CPIH goods annual rate fell from 6.2% to 2.9%, while the CPIH services annual rate fell from 6.3% to 6.2%.

Core CPI (excluding energy, food, alcohol and tobacco) rose by 5.7% in the 12 months to October 2023, down from 6.1% in September. The CPI goods annual rate fell from 6.2% to 2.9%, while the CPI services annual rate fell from 6.9% to 6.6%.

The older RPI measure of inflation fell to 6.1% in October from 8.9% the previous month.

REACTION

Reaction from industry experts was generally positive and many see the current bulge in inflation as coming to an end.

George Lagarias, chief economist at accountants and Financial Planners Mazars, said: “CPI receding at manageable levels probably puts the nail on the coffin of this rate hike cycle.

"We could begin to see the end for this inflation wave, especially if we don’t experience higher energy prices in the next few months. Lower inflation is consistent with the sluggish consumption data of the past two months. As such, one questions still looms large: will the economy that has succeeded in bringing inflation down to more manageable levels, also achieve to keep growth above the recession line?"

Jonny Black, chief commercial and strategy officer at Abrdn, Adviser, said: “While inflation easing to 4.6% is good news, the journey to this point has been slow and steady.

"Inflation-proofing income remains important for clients, and they’ll value their advisers’ help in reviewing their strategies and understanding where price rises may go next.

“This could be influenced by any changes to savings and investing policy announced by the Chancellor in next week’s Autumn Statement. With areas like ISAs rumoured to be under consideration, this will be something closely watched by advisers and their clients alike. Big changes could have big implications for long-term planning.”

Lindsay James, investment strategist at Quilter Investors, said: “The Prime Minister will be breathing a deep sigh of relief today, especially given the political events of the last few days.

"Halving inflation was meant to be the easiest of his five priorities to achieve as it was a year on year comparison, and 2022 saw inflation rise sharply. Although things got a little close for comfort, today’s sharp drop in inflation to 4.6% is a positive step on the long road back to target levels. However, this has been predominantly driven by factors that look unlikely to be repeated in the months ahead.

“Energy prices are the most significant contributor to the fall, with gas costs highlighted as 31% lower in the year to October 2023, and electricity costs down 15.6%. Unfortunately the loss of £400 of support from the government per household towards energy bills makes the real impact on consumers ‘cost of living’ far more modest, whilst gas prices have recently moved higher, reflecting global supply constraints, which will feed into a higher Energy Price Cap from January onwards."

Steven Cameron, pensions director at Aegon, said: “Today’s official inflation figure of 4.6%% from the Office for National Statistics shows the Government has delivered on its promise to halve inflation from its 10.7% starting point by the year end.

“It comes a day after figures show total earnings continue to increase at a rate of 7.9%. While this ‘real’ earnings growth of over 3% is good news for those of working age receiving average pay increases, it piles pressure on the Government as it weighs whether or not to honour the Triple Lock in full next April, with an announcement possibly made as part of the Chancellor’s Autumn Statement."