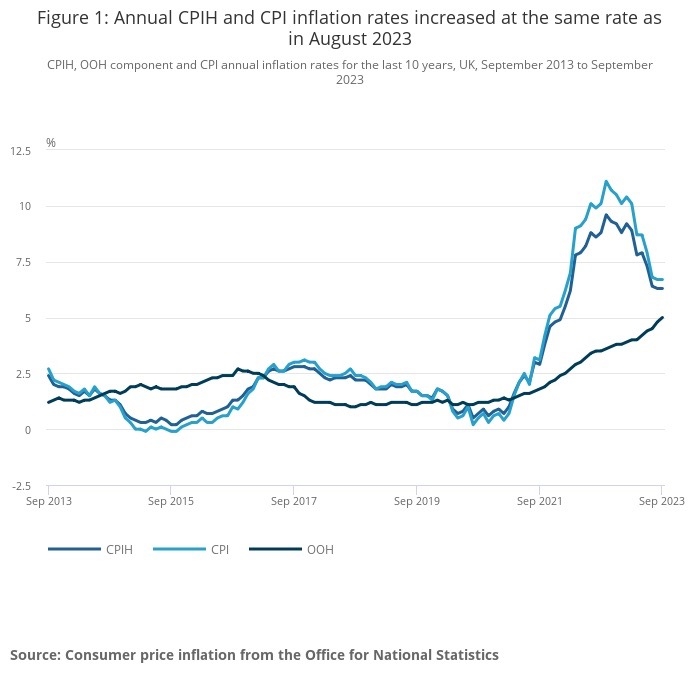

The Consumer Prices Index rate of inflation held steady at 6.7% in September, disappointing some commentators.

The rate, announced today, was the same as August.

Inflation remains stubbornly high despite government promises to half the rate this year to below 5% and push it back towards the 2% long-term target.

The high rate of CPI may put pressure on the Bank of England to hold or increase its 5.25% base rate when it is next reviewed in November.

The Consumer Prices Index (CPI) rose 6.7% in the 12 months to September, the same rate as in August. On a monthly basis, CPI rose 0.5% in September, the same rate as in September 2022, ONS said.

The latest rates of inflation will be used to assess the new State Pension increase under the Triple Lock mechanism. Some experts have forecast a rise in the State Pension of 8.5%.

The sister Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 6.3% in the 12 months to September 2023, the same rate as in August. On a monthly basis, CPIH rose by 0.5% in September 2023, compared with a rise of 0.4% in September 2022.

The largest downward contributions to the monthly change in CPIH and CPI annual rates came from food and non-alcoholic beverages. In these sectors prices fell on the month for the first time since September 2021. In furniture and household goods prices rose by less than a year ago.

Rising prices for motor fuel made the largest upward contribution to the change in the annual rates, ONS said. The situation in the Middle East and moves by Saudi Arabia and Russia to restrict supplies of fuel globally have pushed up the price of crude oil around the world.

Core CPIH (excluding energy, food, alcohol and tobacco) rose by 5.9% in the 12 months to September 2023, the same rate as in August. The CPIH goods annual rate fell slightly from 6.3% to 6.2%, while the CPIH services annual rate rose from 6.1% to 6.3%.

Core CPI (excluding energy, food, alcohol and tobacco) rose by 6.1% in the 12 months to September 2023, down from 6.2% in August. The CPI goods annual rate fell slightly from 6.3% to 6.2%, while the CPI services annual rate rose from 6.8% to 6.9%.

Reaction was mixed among industry experts.

Jonny Black, chief commercial and strategy officer at abrdn, Adviser, said: “The most important thing about this September CPI data is that it is typically one of the three metrics used to determine how much the State Pension may be increased by under the ‘Triple Lock’.

“The other two metrics – average wage growth between May and July and the ‘baseline’ 2.5 per cent – are already known, so this gives some clarity over how much the State Pension could rise by next year, although there can be no givens just yet. It means that advisers will need to be prepared to have new conversations with clients this month about possible changes to their retirement income and what these could mean for their retirement plans.”

Hetal Mehta, head of economic research at wealth manager St James’s Place, said: “Today’s inflation numbers were slightly stronger than expected thanks to services inflation. Combined with yesterday’s partial labour market data, which showed further wage moderation, this isn’t the significant upside surprise that might make the BoE reconsider staying on hold at its next meeting in November.”

Nicholas Hyett, investment analyst at investment provider the Wealth Club, said: “September’s inflation numbers present a messy picture. At the headline level CPI is flat month-on-month, but under the surface there’s a lot of moving parts. Food prices have fallen while more domestically exposed sectors like restaurants and hotels have seen prices rise. Higher prices for motor fuel are also having an effect.

“That makes it a difficult set of numbers to interpret – especially for interest rate setters at the Bank of England. Had inflation continued to fall, as many had expected, then there would be a strong case for rates to stay where they are – slowly squeezing inflation out of the economy. However, if inflation remains stuck at its current stubbornly high level, that’s a whole different kettle of fish. No-one wants inflation to remain stuck where it is for an extended period. If the Bank think’s that’s a danger, they may well feel their only option is to set rates on an upwards trajectory once again.”