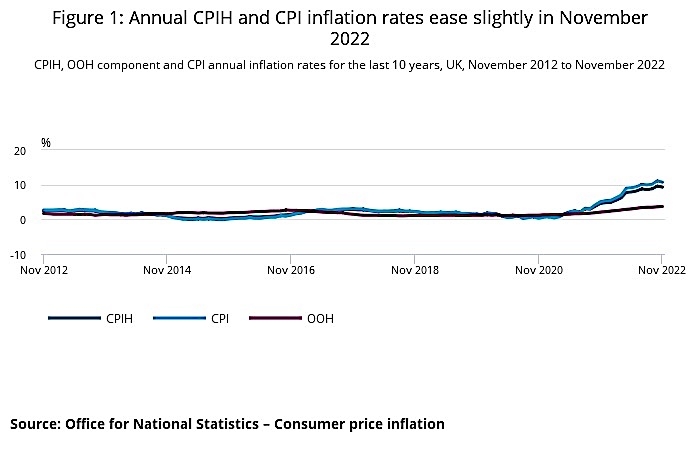

CPI inflation dropped back to 10.7% in November - from 11.1% in October - as petrol prices fell.

The news was welcomed by the industry as a step in the right direction by several warned it would take time to get inflation under control.

The Office for National Statistics said today that the Consumer Prices Index (CPI) had risen by 10.7% in the 12 months to November, down from 11.1% in October.

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 9.3% in the 12 months to November, down from October's 9.6%.

On a monthly basis, CPI rose by 0.4% in November, compared with a rise of 0.7% in November 2021, a sign inflationary pressures may have eased slightly recently

The largest upward contributions to the annual CPIH inflation rate in November came from housing and household services (mainly from electricity, gas, and other fuels), and food and non-alcoholic beverages.

The largest downward contribution to the change in both CPIH and CPI annual rates between October and November came from transport, particularly motor fuels.

Rising prices in restaurants, cafes and pubs were the biggest upward drivers of inflation.

The older measure of inflation, RPI, slipped to 14% from 14.2%.

George Lagarias, chief economist at Mazars, said: “Inflation finally begins to come off globally, as both the UK and yesterday’s US numbers suggest. This is a result of slower demand, lower oil prices and positive year-on-year effects.

"However, we can’t be certain the worst is behind us. The largest threat to global price stability in 2023 comes from China’s U-turn on its Zero-Covid. A paced return to normality from Beijing would be good for global prices. But a rushed end to the policy could exacerbate global inflationary pressures well into the next year. Additionally, Britain is facing a tighter jobs market than many other countries, which means that high prices could be a drag on growth for longer than the rest of the world.”

Richard Carter, head of fixed interest research at Quilter Cheviot, said: “The latest (CPI) data marks a fall of 0.4%, which is far more palatable than the huge 1% increase seen between September and October of this year. While the slight dip is a step in the right direction, the issue of rising food prices and growing household energy bills remains firmly in place. However, considering the US also saw better than expected inflation data yesterday, it is encouraging that we may finally be passing the peak of inflation.

“The Bank of England is set to make its next interest rate decision tomorrow, and a 0.5% hike to 3.5% is widely anticipated as inflation remains uncomfortably high and economists expect inflation to average around 7% in 2023."

Andrew Tully, technical director, Canada Life said: “While the headline numbers grab the news, the reality is underlying personal inflation rates for the things we buy every week, like food and energy, are running way above these headline figures, and our wages and pensions are simply not keeping up.

“We are heading into a period where our living standards are predicted to fall by the largest amount since records began, and today’s inflation numbers will offer little comfort. As an example of the price pressures we face, four pints of milk cost £1.17 in September 2021 but that had increased rapidly to £1.52 by Sept 22. However, even as inflation slows, the price of that milk is likely to stay high, with the price simply not rising as fast as previously. The official economic forecasts are predicting a deep and protracted fall in living standards while we wait for our incomes to catch up.

“For retirees on fixed incomes, the confirmation of a double-digit rise in the state pension from next April is helpful but is likely to offer little comfort in the winter months as the prices pensioners pay for everyday goods is still much higher.”

Jonny Black, strategic director at Abrdn, said: “This week is a thicket of economic data and developments that clients will be closely studying. Inflation’s just the start. Tomorrow, we’ll see whether the Bank of England raises interest rates again or if it will stay its hand.

“Among all the noise, advisers have the critical job of keeping clients focussed on the long-term view. As every adviser knows, the road to poor outcomes is often paved with short-term, knee-jerk decisions.”

Charlotte Jones, senior consultant at XPS Pensions Group, said: “We’re seeing schemes working with companies to explore additional pension increases and support their pensioners through the cost-of-living crisis.

"Whilst the average scheme is much better funded over 2022 there is a wide disparity of experience. For some schemes loss of hedging following the spike in gilt yields and falling growth asset values could mean that long-term security is still a way off. As a result, some schemes are unlikely to be able to boost their pensioners income.”