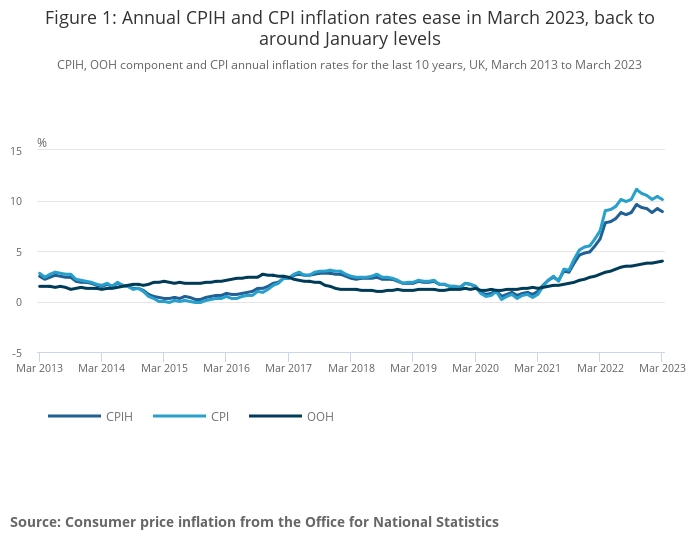

CPI inflation slowed slightly last month, falling to 10.1% in March from 10.4% in February on the back of lower petrol prices.

Latest figures from the ONS today keep pressure on the Bank of England over interest rates, with inflation still well above the 2% target rate.

The Consumer Prices Index including owner occupier costs (CPIH) rose by 8.9% in March, down from 9.2% in February.

The biggest upward driver came from housing and household services (principally from electricity, gas and other fuels), and food and non-alcoholic beverages.

Food prices increased by 19.1% year-on-year, the sharpest jump since August 1977, and up from 18.9% in February.

Bread, cereals and fruit prices increased, while the impact of vegetable shortages also continued to weigh on inflation.

The largest downward contributions to the monthly change came from motor fuels, and housing and household services (particularly liquid fuels), partially offset by upward contributions from food, and recreation and culture.

Petrol and diesel costs were down 5.9% against the same month last year after prices had spiked following Russia’s invasion of Ukraine.

On a monthly basis, CPI rose by 0.8% in March, compared with a rise of 1.1% in March 2022. On a monthly basis, CPIH rose by 0.7% in March, compared with a rise of 0.9% in March 2022.

The 12 month RPI (Retail Prices Index), an older measure of inflation, fell to 13.5% in March from 13.8% in February.

Nathaniel Casey, investment strategist at Evelyn Partners, said: “Although inflation remains elevated it has realigned with its downward trends. Additionally, Inflation should decelerate at a faster rate through the second quarter as large rises in energy prices from last year drop out of the annual comparison.

“Nonetheless, inflation still has a long way to go to return to the BoE’s mandated target of 2%.”

Marcus Brookes, chief investment officer at Quilter Investors, said: “With the headline rate of inflation eventually coming down to hopefully more palatable levels, there will be an increased focus on what is going on under the bonnet with core inflation.

“This measure failed to shift in March and this will be a real concern to the BoE. Should that fail to fall meaningfully in the next couple of months, then more aggressive monetary policy from the BoE may be required yet again.”

George Lagarias, chief economist at Mazars said: “We still expect that UK inflation will drop significantly next month due to the year-on-year-effect. But it will take UK inflation longer to fall relatively to the rest of the developed world, because of Britain’s idiosyncrasies in the supply chain and the jobs market.”