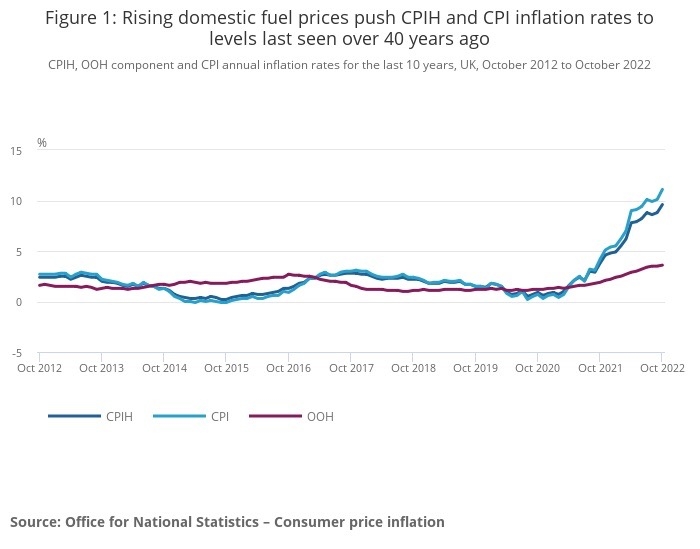

The Consumer Prices Index rose to a 41-year high of 11.1% in October as prices rose in many sectors, with warnings of potential further rises to come.

The 12 month inflation figure of 11.1% is the highest for over 40 years and suggests the government will need to do more to bring inflation under control.

The sister CPIH index (Consumer Prices including owner occupiers' housing costs (CPIH) rose by 9.6% in the 12 months to October, up from 8.8% in September 2022.

The ONS said the largest upward contributions to the annual CPIH inflation rate in October came from housing and household services (mainly electricity, gas, and other fuels), food and non-alcoholic beverages, and transport (mainly fuel costs).

On a monthly basis, CPIH rose by 1.6% in October 2022, compared with a rise of 0.9% in October 2021.

The CPI 12 month figure of 11.1% was a significant increase from the 10.1% seen in September.

ONS said that despite the government's Energy Price Guarantee, gas and electricity prices made the largest upward contribution to the change in both the CPIH and CPI annual inflation rates between September and October.

Rising food prices also caused a large upward contribution to the CPI increase with transport (mainly motor fuels and second-hand car prices) also a major cost increase sector.

The older RPI measure of inflation hit 14.2%.

Reaction from the experts was one of concern with warnings of potential further rises in inflation to come.

Rachael Griffin, tax and financial planning expert at Quilter, said: "UK inflation has risen once more, reaching 11.1% in October – a significant increase of 1% compared to September’s 10.1%. This figure is expected to climb further still in the coming months, and this latest data shows inflation has already surpassed the Bank of England’s prediction that inflation will rise to around 11% in Q4 2022. Rising food prices continue to have a significant impact, but growing household energy bills were the primary reason for the increase this month.

“All eyes will be keenly watching the Chancellor as he lays out his long-awaited Autumn Statement tomorrow, during which he will outline the government’s plan to fill the current hole in public finances. The freezing of various tax thresholds and allowances for an additional couple of years is widely anticipated as the Chancellor looks to take advantage of rising inflation."

Andrew Tully, technical director, Canada Life, said: "The cost-of-living crunch shows no sign of slowing as we head into a very tricky winter. Tomorrow’s Autumn Statement is unlikely to provide any immediate relief for households already struggling to make ends meet.

“With personal inflation rates at an eye-watering level, pensioners reliant on the state pension will be pinning their hopes on the Chancellor re-committing to a double-digit increase through the triple-lock promise, but even then this will hardly match the price rises pensioners are experiencing.”

George Lagarias, chief economist, Mazars, said: “Consumer inflation continues to squeeze real incomes, as energy and food prices persist with their climb. Tomorrow’s budget will, in all probability, only exacerbate consumer angst, setting the coming winter up to be, from an economic standpoint, one of the most difficult in recent memory.

“However, a closer look at the numbers leaves some room for optimism. Services inflation, the ‘sticky’ part, remains unchanged. Meanwhile, house prices have begun to decelerate significantly, offsetting some of the rising mortgage costs for would-be buyers. Eventually, the confluence of lower housing wealth, a tight fiscal regime, high interest rates and surging energy prices should dent consumption enough to bring inflation down to manageable levels. Should labour shortages be addressed, we would expect a faster taming of inflation.”

Jonny Black, strategic director at abrdn, Adviser, said: “October’s rise in inflation underlines the need for Government intervention ahead of tomorrow’s fiscal statement.

“However, while many of the measures Jeremy Hunt is set to announce are designed to tackle rising inflation, widely anticipated changes to tax thresholds and allowances could compound the pressure on clients’ finances and reduce the amount of capital they have to invest and save for the future.

“This year advisers have been supporting clients to maintain a balance of investments that meets their long-term financial goals in a high inflation, high interest rate environment. Advisers must continue to help them understand what an increasingly difficult economic climate means, and how best to protect their money as – if Bank of England forecasts are correct – the UK heads towards recession. The critical thing is to discuss options and agree a plan as early as possible.”