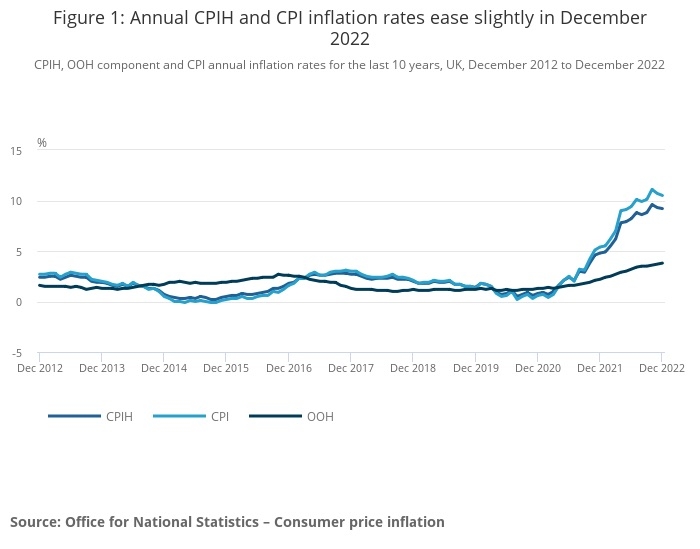

CPI inflation continued its recent downward trend in December for the second month with a fall from 10.7% to 10.5%.

CPI has dropped by 60 basis points since it peaked in November at 11.1%.

ONS said the latest fall was mainly due to a drop in petrol prices and lower prices for clothes, footwear and recreation and culture.

Upward pressure on inflation came from housing and household services, mainly gas, electricity and other fuels, and from food and non-alcoholic beverages.

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 9.2% in the 12 months to December 2022, down from 9.3% in November.

On a monthly basis, CPIH rose by 0.4% in December 2022, compared with a rise of 0.5% in December 2021.

RPI inflation, the older measure of prices, fell from 14% in November to 13.4% in December.

The drop in inflation was welcomed by most experts as a step in the right direction but several pointed out that inflation was still at a 40 year high.

Jonny Black, strategic director at abrdn, Adviser, said: “Stubbornly high inflation will drive demand for advice from new and existing customers this year.

“People, at all life stages, are needing support navigating what is a highly uncertain and fast-changing environment. Once again, the sector has a huge opportunity to demonstrate its value by helping people keep working towards their long-term financial goals, and not get blown off track by this storm of financial headwinds.

“Inflation isn’t just a customer issue. Firms themselves will be grappling with a higher cost of doing business. Advisers and management teams will already be well underway with their 2023 growth plans. If they haven’t already, considering everything they can do to help mitigate overhead cost rises – for example, by driving efficiencies through platform technology – will be essential for their ongoing resilience, and their continued success.”

Annabelle Williams, personal finance specialist at online investment firm Nutmeg, said: “The high cost of living was never far from the headlines in 2022 as inflation soared to levels last seen in the 1980s. A surge in pent-up demand for goods following the Covid pandemic and shipping problems internationally had already created some inflation as the year began, before Russia’s invasion of Ukraine pushed global gas and oil prices higher, fuelling inflation further. Consumer price inflation reached 11.1% in October and in November came in at a more muted 10.7%.”

“This latest update will be closely watched for signs of optimism for the months ahead. The good news is that energy prices have softened, with wholesale gas costs closer to levels before Russia’s invasion of Ukraine, which should start to be reflected in the figures.

“The tough reality is that it’s impossible to predict the future and an unexpected event can make a mockery of any forecasts. If there’s one lesson to take from recent history, it’s that it pays to be prepared where you can. People could take advantage of higher interest rates on savings, use cashback offers when making purchases and budget for a clear view on where their money is going.”

Nicholas Hyett, investment analyst at the Wealth Club, said: "Inflation continued to slow in December, and now looks to have peaked in October last year.

"Lower fuel prices have been a major contributor to the slowdown, and with oil prices now back around where they were before the Russian invasion of Ukraine, there's likely to be further to fall on that front. As a crucial input into other areas of the economy, lower oil and fuel prices should ultimately ease pricing pressure across the board - although it will take time for the benefit to feed through to people's purses.

"For now, the cost of living crisis is set to continue. 10.5% inflation may be better than we've seen recently but is still eye-watering by most standards. A winter of strikes ahead yet see 'stickier' wage driven inflation gathering pace too.

"Still, the government and Bank of England will be encouraged by these numbers. If inflation is trending down naturally then interest rates may not need to go so high, which will at least keep debt more digestible for consumers, companies and countries around the world."