Transact will cut its charges from tomorrow.

The platform has made the move to reduce the annual commission charge from 0.31% to 0.30%.

The charging threshold of £150,000 will be reducing to £120,000.

Transact said this will be its 10th price reduction since 2008, adding that this followed its principle of ‘responsible pricing’, whereby cuts are made only when “confident it will not jeopardise the award-winning service”.

Currently Transact Portfolios valued up to £150,000 are charged at 0.5% in Annual Commission on the first £60k of investments.

Source: Transact

With both reductions considered, a Transact client with a Portfolio value of £120k will now pay £126 less per annum - a saving of over 25%, according to the firm's figures. The reduction is set to benefit over 95,000 clients, Transact stated.

Jonathan Gunby, chief development officer, stressed the firm was committed to providing its service at a price which would "not affect the sustainability of our business model".

He said: “Our ability to operate a profitable business year on year continues to result in better outcomes for advisers and their clients.

"As always, we want to make doing business and managing portfolios with Transact as simple, efficient and cost-effective as possible.”

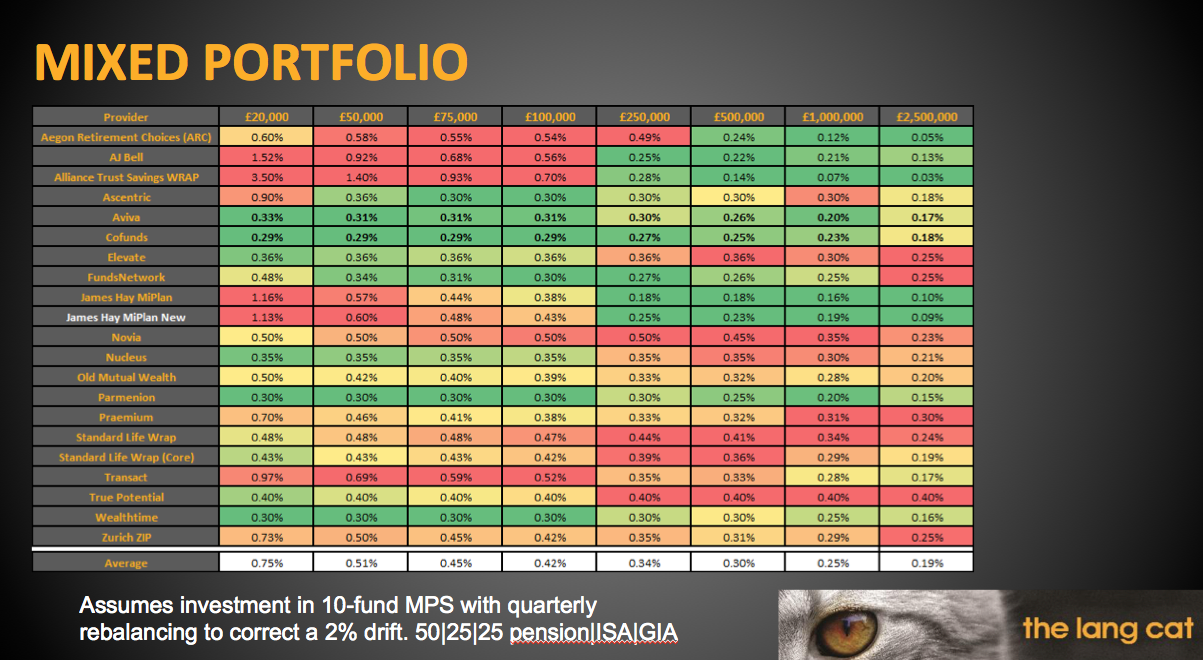

Below, courtesy of the Lang Cat, is a platform charges comparison table it recently released, based on figures up until this month.