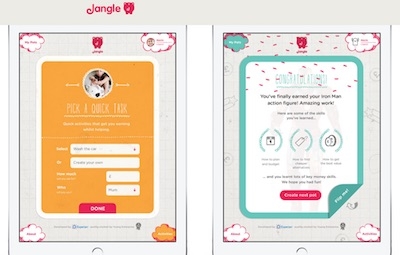

One of the stars of Dragons’ Den has helped launch a free smartphone app to teach children about managing their money and financial planning.

Sarah Willingham, part of the quintet of investors who feature on the hit BBC2 show, has thrown her weight behind Jangle, which was developed with Experian.

The non-commercial programme, which has been quality marked by pfeg - part of Young Enterprise – is designed for children aged 7 -11.

The creators said it was “a fun and easy way to help teach children essential skills about how to manage money well while helping them save for the things they want.”

They also hope to make parents rethink how the way they hand out pocket money, encouraging them to create a culture of earning the cash - by doing chores for example.

Ms Willingham, a mum of four, said: “It’s absolutely crucial that we equip our kids with the tools they need to understand and manage their money later in life, and that we start early whilst their feelings and expectations around money are being set.

“It’s clear that kids’ attitudes towards money are shaped at a much younger age than we think, so we need to start the process of talking about money at home as early as possible.

“Pocket money is often the first experience children have of managing money, and I’d like us, as parents, to take a more active role in teaching our kids the importance of earning their pocket money and saving for the things they’d like.”

A survey by Experian found 61% of parents felt that their child could receive more support about how to manage money well in the classroom.

Clive Lawson, managing director at Experian, said: “I learnt recently that behaviours and attitudes towards money can be set from as early as seven, which really surprised me. It’s also one of the reasons I’m so happy to have had the opportunity to work with Sarah to develop Jangle, a great new and free app that teaches children money skills while helping them save.”

Mr Lawson said: “My children’s financial future and happiness is never far from my mind but I’ll equally hold my hand up to not always being able to find the time to really invest in helping them learn the money management lessons I wish I had learnt sooner in life.

“There are so many rites of passage that young adults should experience as they become independent, but struggling to manage unaffordable debt does not need to be one of them.”

The Experian poll showed 85% of children did not always have to earn money by doing chores, for example.