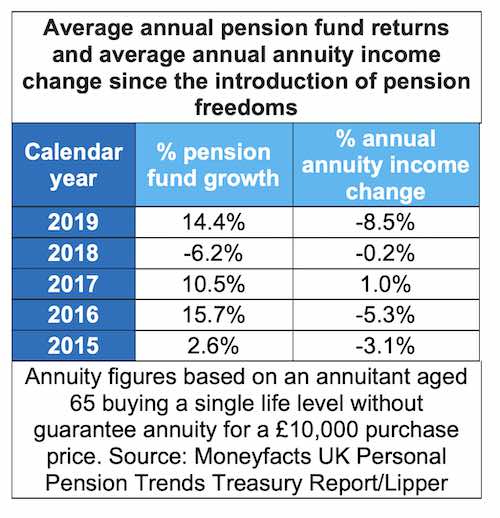

Pensions drawdown investors have seen positive growth in four out of the five years since the Pension Freedoms arrived in 2015, according to a new study.

While most drawdown investors have seen good returns annuity buyers have seen falling rates.

New data from the latest data provider Moneyfacts UK Personal Pension Trends Treasury Report, to be published later this week, reveals those in drawdown benefited from strong pension performance last year in contrast to those locked into lower, but more secure, annuity rates.

According to the report, the average pension fund returned 14.4% during 2019, the strongest pension fund performance since 2016.

By contrast, average annual standard annuity income fell by between 8.5% and 9% last year (depending on the purchase price), the second-heaviest annual fall Moneyfacts has recorded. The drop was surpassed only by the falls of between 9.4% and 11.5% during 2012.

Moneyfacts says that on a more positive note, Q4 2019 provided “calmer waters” for annuity rates, with rising gilt yields enabling annuity providers to boost the average annuity income by between 4% and 4.6%.

Richard Eagling, head of pensions at Moneyfacts, said: “The growing number of individuals in defined contribution pensions schemes and the increasing popularity of drawdown mean there is now huge pressure on pension funds to perform in both the accumulation and decumulation phases of retirement.

“Indeed, our own drawdown survey recently found that 65% of drawdown customers are not taking a regular income, meaning that the vast majority remain highly exposed to stock market movements.

“Despite considerable economic and political uncertainty, 2019 was generally a strong year for pension fund performance. It was however a different story for annuities, with annuity rates suffering their second-heaviest annual fall last year.”