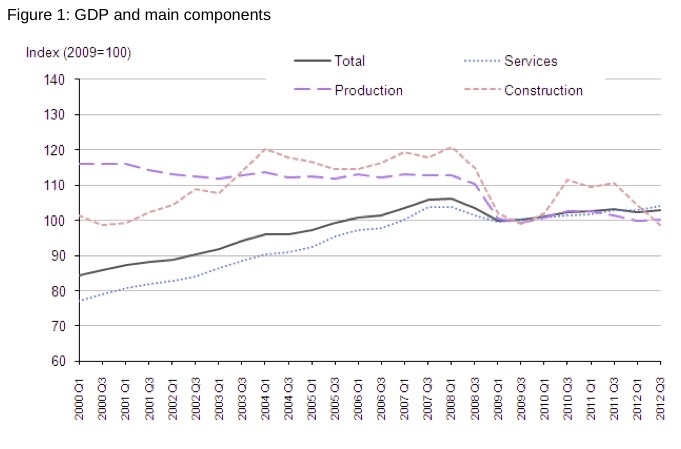

The Office for National Statistics has estimated that GDP increased by 1 per cent in Q3 2012 compared with Q2 2012 with business services and finance returning to growth.

The index for business services and finance was estimated to have increased in line with the overall GDP growth estimate by 1 per cent in Q3 2012, following a flat picture in the previous quarter. ONS says that output increased in 16 of the 21 component sectors in this category and employment activities and rental and leasing made the largest positive contributions to the increase.

Economists have said the Olympics probably boosted output and it is uncertain whether the economy will slip back into recession in the next quarter but Government figures were more buoyant, saying the figures represented positive news along with recent figures on unemployment and inflation.

The output of the production industries was estimated to have increased by 1.1 per cent in Q3 2012 compared with Q2 2012, following a decrease of 0.7 per cent between Q1 2012 and Q2 2012.

Construction sector output was disappointing and estimated to have decreased by 2.5 per cent in Q3 2012 compared with Q2 2012, following a decrease of 3.0 per cent between Q1 2012 and Q2 2012.

Output of the service industries was estimated to have increased by 1.3 per cent in Q3 2012 compared with Q2 2012, following a decrease of 0.1 per cent between Q1 2012 and Q2 2012.

GDP in volume terms was estimated to have been flat in Q3 2012, when compared with Q3 2011.

The preliminary estimate of GDP focuses on the growth in output between two consecutive quarters. GDP was estimated to have increased by 1.0 per cent in the third quarter of 2012. The largest contribution to the increase came from the services sector. There was also an increase in activity in the production sector. Activity in the construction sector fell.

The latest GDP estimate was affected by the changes made to the quarter two Bank Holidays in May and June 2012 as part of the celebrations for the Queens Diamond Jubilee. The end of May bank holiday moved to June and there was an additional day's holiday in June. Over the second quarter, this resulted in one fewer working days.

ONS says that in addition to the impact of the bank holiday changes, the latest GDP estimate was affected by the Olympics and Paralympics events in the third quarter which are likely to have boosted GDP.

Trevor Greetham, director of asset allocation at Fidelity, was sceptical about the improvement.

He said: "The UK economy remains essentially flat with UK GDP at the same level as a year ago despite a strong boost from the Olympics and other one off factors.

"The clear winner since the financial crisis is the US where economic activity is well above its 2007 level and on a steadily rising path and where the housing market is beginning to show signs of life.

"Both countries engaged in aggressive quantitative easing. The big difference with the US is on the fiscal side where neither political party is expected to cut government spending significantly until the economic recovery is well established.Forget Plan A and Plan B. What's working is Plan USA."