The FCA has revealed it received 4.29m complaints in the first half of 2019.

The data showed an increase in complaints from 3.91m in the second half (H2) of 2018 to 4.29m for the first half (H1) of 2019.

The increase in complaints was mainly driven by a 34% increase in the volume of PPI complaints received, from 1.58m to 2.12m.

PPI complaints made up 49% of all complaints received during this period, continuing to be the most complained about product.

While PPI complaints increased in the first half of 2019, there was a 6% drop in the number of non-PPI complaints, from 2.32m in 2018 H2 to 2.18m in 2019 H1.

When PPI is taken out, the figures were the lowest volume of complaints firms have received since new reporting rules came into effect in 2016.

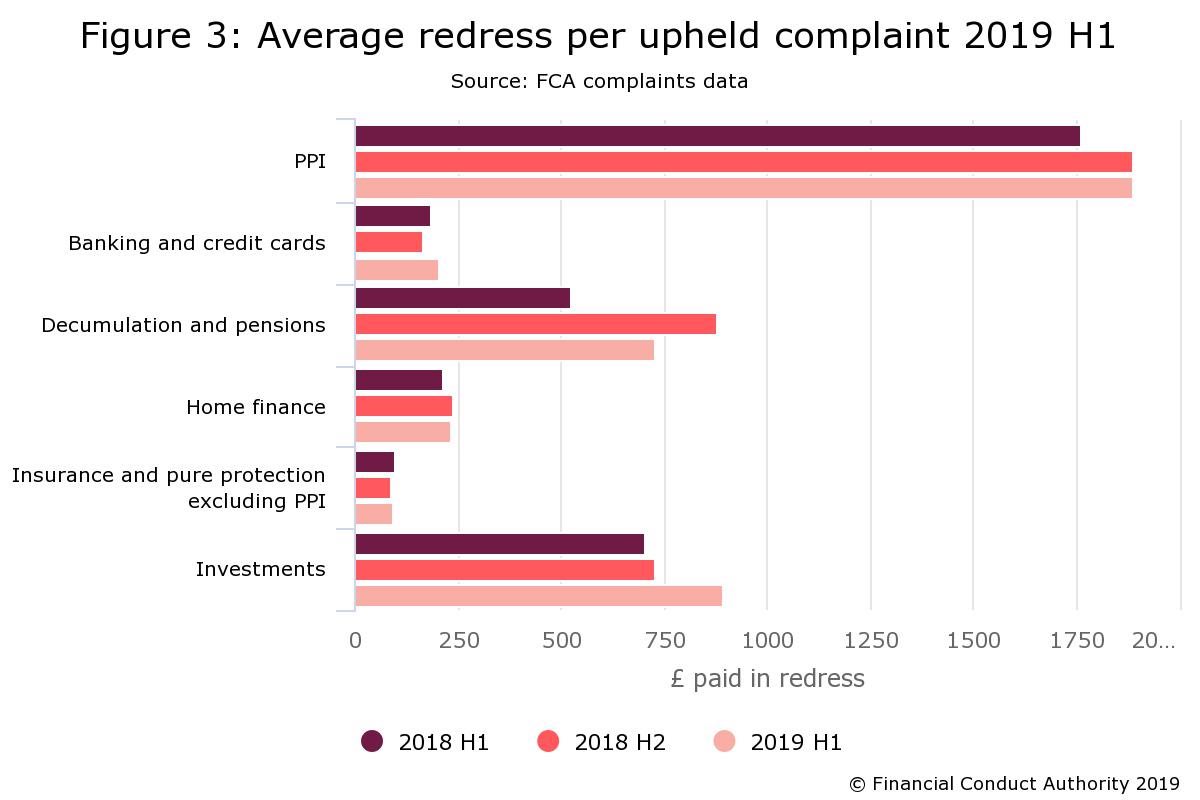

In terms of compensation upheld complaints about decumulation and pensions received an average of £730.

This was lower than in 2018 H2 where an average of £877 was paid per complaint.

Excluding PPI complaints, the most complained about products were current accounts (14% of reported complaints), credit cards (8%) and motor and transport insurance (6%).

The average volume of complaints received per 1,000 accounts for banking and credit cards has decreased to 4.2, compared to 4.6 in 2018 H2.

This was also the case for home finance, which decreased from 9.6 to 8.7 complaints per 1,000 mortgage accounts.

Overall, excluding PPI, the average redress per complaint upheld increased from £175 to £200 between 2018 H2 and 2019 H1.

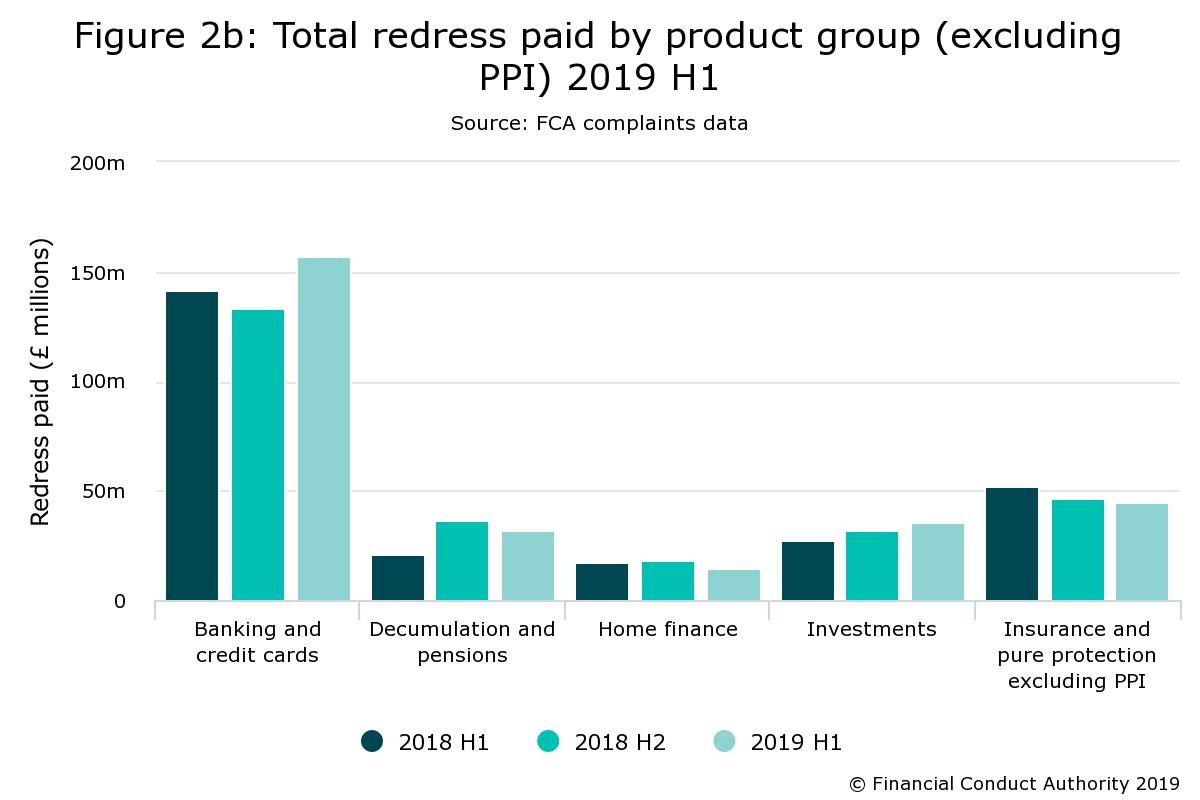

Over 2018 H1, 2018 H2 and 2019 H1 the total paid for complaints about decumulation and pensions decreased by 14%.