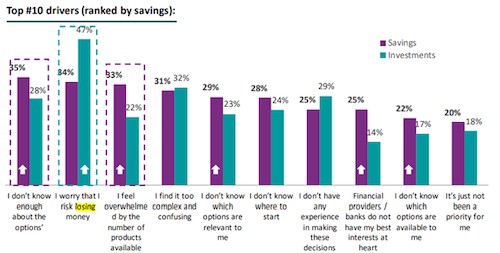

The risk of losing money is the reason why almost half (47%) of consumers are reluctant to invest, according to a new report.

While consumers believe saving (44%) and investing (25%) are the right thing to do, they are afraid of taking risks with their money.

Many also struggle to find the support and reassurance they need to invest, according to research for financial services body The Investing and Saving Alliance (TISA).

Over a third (34%) said they have concerns about losing money when it comes to choosing a savings product.

The consumers surveyed said the sources they turn to for information on savings and investments are online resources, friends and family, and online forums.

Regulated financial advice was viewed as expensive and the preserve of the wealthy.

Source: TISA research

TISA has called for current financial regulations to be amended to allow a wider range of online tools from providers to help savers make decisions around investments. Almost three-quarters (73%) of consumers surveyed would appreciate “access to a savings tool which makes it quick and easy to input data and select relevant savings products”. Some 63% said the same about choosing a relevant investment product.

Prakash Chandramohan, strategic policy director at TISA, said: “Consumers who are currently not seeking high-quality advice are being let down by the lack of personalised support and guidance available from the industry. Consumers need this type of support to help them make savings and investments decisions. Not surprisingly, consumers are turning to often unreliable online resources as well as friends & family to seek help and support with their financial decisions. There is a significant risk that financial services firms will lose the consumer engagement battle.

“The regulatory framework needs to change to level the playing field and enable the industry to help create a sustainable savings and investment culture amongst UK adults.

“The FCA recently estimated that there are 38 million people who are not using any formal support to assist them with their finances. It’s simply not realistic to expect the UK’s ‘Advice Gap’ to be plugged by 38 million extra people taking regulated financial advice. Full advice can be highly beneficial, but the perception amongst consumers is that advice is for the wealthy or older generations.

“Consumer support also needs to come from the wider financial services industry - product providers, banks and building societies – but it needs to be provided in a way that engages consumers.”

The research was commissioned by TISA and undertaken by EY Seren. Basic details have so far been released with the full research due to be published next week.