Life Planning has become a popular style of Financial Planning among UK planners over the last few years. Our sister magazine Financial Planner recently interviewed the US-based founding father of Life Planning George Kinder to ask him about how the model is developing here in the UK and what the future holds.

FP: George, while many planners in the UK will have heard of Life Planning, many may not understand exactly what it is. Can you explain some of the key principles of Life Planning and how it is different to Financial Planning?

George Kinder: There's no difference. Life Planning is "Financial Planning done right." I don't agree that it's different. It's not "a popular style of Financial Planning," as some put it, rather it's the only way to do Financial Planning. Life Planning involves a reflective, purposeful even profound approach to goals that clarifies financial objectives as a significant subset of personal goals along with an empathic response to client aspirations and concerns. It's a foolproof process that delivers what the client most wants in their life.

If you don't have a strong element of Life Planning at the beginning of the process Financial Planning's not much different from product selling. If you don't put your clients first, make it their meeting, listen far more than talk in the early stages, and if your clients don't leave your office exhilarated by the engagement, you're likely not doing Financial Planning, far less Life Planning, and your clients won't get much from the engagement.

FP: What are the roots of Life Planning and why did you create it?

GK: I suppose the roots are in the Magna Carta and Declaration of Independence. It's really all about freedom. What we drive to in our engagements is the delivery of the greatest possible freedom for the client, in their own terms, in the shortest times possible, and utilising all the financial skills at our disposal.

The other root is the primary skill used to deliver freedom: Listening to the client rather than imposing our agenda, using the simplest of open ended non financial questions and then a profound and inspiring goals process.

I created the process because I believe money is fundamentally about freedom and it seemed that all the product sellers, the regulators and institutions failed to understand that simple fact, other than perhaps as a sales technique.

FP: How many Life Planners are there now worldwide and how many in the US and UK?

GK: I suspect there are tens of thousands worldwide who believe they are doing some form of Life Planning with their clients. The Seven Stages of Money Maturity alone has sold 40,000 copies, probably half to financial advisers. We've trained nearly 2000, most of them listed on the website, nearly 400 in the UK, over 1000 in the US. Over 300 have gone through our slate of courses to become Registered Life Planners®.

FP: You've spent considerable time in the UK over the past few years promoting and teaching Life Planning. Has it been the success here that you expected?

GK: Not at all. It's been much more amazing than I had thought. It's been beyond my wildest dreams. Sure, there were disappointments along the way. Some of them are:

1. The small 'cottage industry' sector – earnest, passionate – great practitioners and advocates, but many qualitative levels of adaptation of Life Planning and the time and money commitments for training and implementation can seem significant – steady and strong in this group but I would have hoped quicker.

2. Large institutions have been among the most inspiring trainings I've given, with enormous possibilities there for institutionalization and ratings through the roof: "greatest training by far in 29 years" but then it gets all chopped up from the managers and bosses who don't understand it, and still have a product mindset

3. LifeSpire has gone far beyond all this. It's the firm I'm launching with Steve Conley (ex head of investments at HSBC, Santander, RBS) and other Registered Life Planners. We've landed the funding to make something really big that is consistent in Life Planning practices from office to office all across the country. In addition to Life Planning we will be offering within LifeSpire and to the broader adviser audience an index-based Centralised Investment Process that will cut costs dramatically for most firms.

FP: Is Life Planning in the UK different to the styles of Life Planning used elsewhere in the world when it comes to execution?

GK: Not much. Probably the main difference with the US is the burden of regulations on financial advice in the UK, but Life Planning itself is unregulated. I look forward to the possibility of reducing regulation in the UK as Life Planning absent of product-selling becomes the norm.

FP: What have been the challenges in developing Life Planning in the UK and globally?

GK: Just time and money, and those are constraints largely on individual IFA's. I'm hoping to change much of that with LifeSpire.

FP: Some critics have suggested that Life Planning is not 'scientific' enough when it comes to Financial Planning and relies too much on 'emotional answers' How would you respond to this?

GK: Apparently some people think money is not an emotional topic, more of a dinner table kind of conversation where one easily shares with others one's income, net worth, the value of one's real estate, inheritances and so on. I suppose they would argue that the financial consequences of divorce are not emotional, or investment losses, that death is not an emotional topic, nor fraud, job losses, theft, disability or inheritance inequities.

They would certainly be in good company as no Financial Planning text books mention that these might be emotional topics to cover in a financial meeting. Perhaps they also disagree with current thinking in psychology that you can't think and feel at the same time, and that moisture in a client's eye suggests it is the proper time for a joke or portfolio construction.

Obviously, I disagree. But my greatest disagreement with such critics would be with their assumption that human aspirations are not emotional, have no passion to them and deserve a strictly scientific approach in the office of a Financial Planner. Quite to the contrary it is our belief that the passion of those aspirations should be the driving force in any Financial Planning meeting. Give any client the choice between being scientifically dissected or analyzed in a Financial Planner's office or leaving that office exhilarated, confident, trusting and secure in their financial engagement in the world, no one but a robot would want the former.

FP: Has Life Planning evolved a great deal from when you first came up with the concept and in what way?

GK: Yes, it's gone from a psychological and philosophical approach (Seven Stages of Money Maturity) to a practical implementation approach based on great listening skills, exceptional goal work and a foolproof 5 phase (EVOKE) implementation process with measurable business objectives and deliverables at the end of every phase.

FP: What do you see as the future of the UK Financial Planning sector? RDR is now well behind us so how will the sector develop? Growth seems slow at times, do you agree with this? Is it because Financial Planning is too expensive to deliver to clients?

GK: As Financial Planning fully embraces Life Planning (hi tech, hi touch) it will become the primary driver of entrepreneurial endeavours in the UK. As Life Planning becomes a household word for a financial process that models integrity and delivers freedom, Financial Planning will grow like gangbusters.

The slowness we perceive at present is still driven by the banking crisis and the ongoing decimation of trust in financial advice.

A consumer using a commission-based adviser often wasn't aware how expensive financial advice was and they're now asking, why pay so much? And why so much time? I suspect we need to become leaner in our process. Not everyone needs everything we have to offer. But the main value-add for the consumer is Life Planning. We need to articulate that to the consumers and the press. It's why I've written my new book and created a new website for consumers.

FP: What are your own personal plans and how have you embedded Life Planning into your own personal financial plan?

GK: I love what I do. I have great balance in my life, from a thrilling business to the delight and quiet in the creative process for the books and photography that I do. Delight as well in my family, community, kids and the different places we get to visit every year, especially London and Hawaii.

FP: What would be the perfect day for you outside work?

GK: Hiking and meditating with friends and family through the Haleakala crater or jungles of Maui in Hawaii or walking through the streets of London – stopping in parks or at music or theatre.

FP: What new developments are coming along from you?

I have a new book just out: Life Planning for You: How to Design and Deliver the Life of your Dreams on Amazon. It's inspirational (with great stories) for promoting financial Life Planning to prospective clients.

We hope, together with its website, that we can brand Life Planning for the consumer as something the best Financial Planners do. I'm also excited about our new Adviser Life Planning website, our new simplified retirement tool called BERT (if you don't have a few hours for cashflow modelling), our Profiles in Life Planning video series and our search-engine for consumers to find an adviser they can trust.

Biography

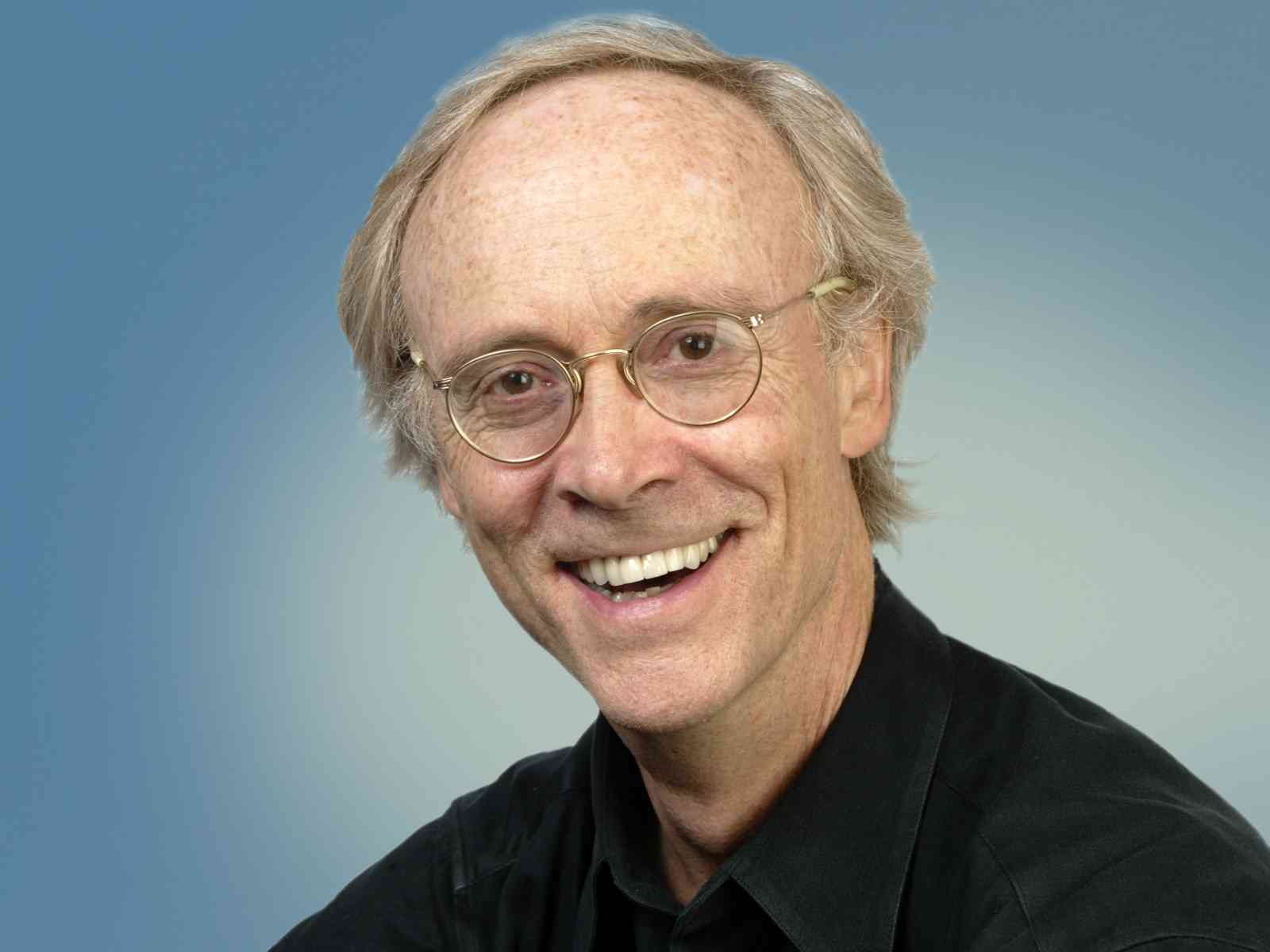

Recognised as the father of the Life Planning movement, the Harvard-educated Mr Kinder is the Founder of the Kinder Institute of Life Planning whose training courses are recognised by many as valuable in teaching client-adviser relationship skills. A listing of nearly 2000 trained advisers on six continents can be found at www.kinderinstitute.com.

Mr Kinder has been profiled by media in many countries and is sought-after for his keynote speeches. Among his numerous books, three are considered seminal in the burgeoning field of Life Planning. His most recent for consumers, Life Planning for You has accompanying websites (lifeplanningforyou.com) for consumers and advisers.

My Day: George Kinder

MORNING

5:30-7: Meditation, yoga, tai chi, exercise, outdoors

7-8: Family

8-12: Creative, free time; includes writing and photography, but really whatever discipline calls me outside work

AFTERNOON

12-1: Lunch and web

1-6: Work/meetings/emails/phone calls/Skype around the world

EVENING

6-8:30: Family time

8:30-9:30: Read

9:30-5:30: Sleep

Key points

1. Live your Life Plan. Nothing is more important than this. Our greatest contributions are our lives.

2. Model Integrity and Deliver Freedom – A Life Planner's motto. Delivering freedom to everyone we meet is what Life Planning is all about.

3. It's time to institutionalise Life Planning and brand it so it's recognizable to consumers all over the UK, all over the globe – on every street corner.