Years of surveys have shown that consumers value the personal touch and want an adviser who recognises their individual needs and characteristics. This demand for ‘personalisation’ relates not only to clients’ assets but also to their gender.

Men and women have different attitudes to money and as such, different attitudes to their choice of Financial Planning style. As the number of female high net worth individuals rises, this difference becomes even more valid.

Figures from the Merrill Lynch- Capgemini World Wealth report indicate that 27 per cent of the world’s high net worth individuals (those with over £625,000 in investable assets) are female. In Europe 18 per cent of high net worth individuals are female.

This article will focus on two recent reports produced by HSBC “Future Retirement - Why Family Matters” and Barclays Wealth “Understanding the Female Economy - the Role of Gender in Financial Decision Making.” Both companies have divisions that are IFP sponsors. The HSBC report questioned 17,000 people in 17 different countries while the Barclays Wealth survey, conducted by Ledbury Research, questioned over 2,000 high net worth individuals (those with over £1m in investible assets) in 20 countries worldwide. The reports noted the differences found between male and female attitudes to their finances and their Financial Planning.

It found a number of differences such as that women were less risk tolerant than men, less likely to have a financial plan and less likely to take responsibility for the finances. It also found women were more likely to seek financial guidance from others.

The HSBC survey found nearly two thirds of women classed themselves as conservative investors and this figure rose to 46 per cent of women in the UK compared to only 34 per cent of men.

Western women in countries such as UK, USA and Canada were noted as being particular risk-averse compared to their developing market counterparts, China was the only country surveyed where women were less risk averse than men. This risk- averse attitude came across in their choice of savings with the majority of women choosing cash savings accounts rather than mutual funds and investments.

These finding were boosted by an AXA Wealth report on risk perception and actual risk. It found most men rated themselves as cautious/ moderate but were actually at the higher end of cautious. In contrast, women underestimated themselves with 32 per cent rating themselves as very cautious when actually most were cautious showing they may feel more cautious more than they actually are.

Caspar Rock, chief investment officer at AXA Wealth’s investment company Architas, said: “There appears to be a clear case of misplaced male confidence in the data, with men overestimating their appetite for risk, while women were more likely to underestimate their risk score. Ultimately, men had a more adventurous profile but overestimated quite how adventurous they are. This rather plays into the stereotypes but clearly there is some truth in this particular battle of the sexes.”

It also found 72 per cent of women rated the thought of risk- taking as making them feel uneasy or nervous. Only nine per cent said it made them excited or invigorated.

This view was echoed by Dr Emily Haisley, who works within the Barclays Wealth behavioural finance team, who said: “Emotionally, women tend to experience emotions more strongly than men and are more prone to experience fear than anger, both of which can make the downside of risk more threatening.”

According to the Barclays Wealth report, women were less likely to choose high risk investments or take financial risks even if it would achieve high returns. All firms agreed that the figures represented a challenge for financial advisers and that the industry needed to do much more to educate people on risk and accepting a greater level of long-term investment risk.

One reason that women were less willing to take on risk and more risky investments could be the fact they feel less financially experienced than men. Men were 50 per cent more likely than women to rate their experience as expert while the majority of women rated their own experience as basic or moderate.

However, this could be good news for Financial Planners as it indicates that women may be more likely to seek help with their finances.

Half of women said they would speak to family and friends about their finances and 31 per cent of women said they would consult a professional financial adviser, according to HSBC. In contrast, men were more likely to do their own financial calculations or do research online.

However, according to Barclays Wealth, while women were more willing to seek guidance on financial matters they were less keen to delegate decisions to others such as by using a portfolio manager. Barbara-Ann King, head of female clients at Barclays Wealth, said: “They do not simply want to delegate; they are keen to have greater control of their financial decisions, through seeking the advice of others.”

Women were also less likely to take responsibility for their finances generally. The HSBC report found household budgets were the only place were women had more responsibility than men. Other features such as mortgage repayments, credit card bills and paying for insurance were handled by men. However, this may be a generational issue as when the figures were broken down into age groups couples in their thirties cited an equal split in household budgeting. Despite this, 47 per cent of women said they participated jointly in financial decisions while 65 per cent of men said they acted alone.

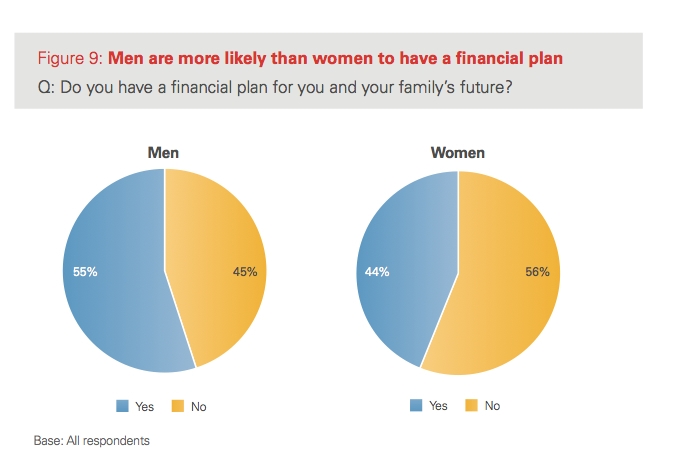

The HSBC report said: “When asked who was involved in making or reviewing any financial plan, women claim to feel included in making joint household decisions about the finances, whereas men claim to be making important financial decisions on their own. This is an interesting insight into people’s perceptions of how financial decisions are made and raises questions about how involved women really are.” Worryingly this lack of involvement meant that women were less likely than men to have a financial plan.

Some 44 per cent of women had a financial plan compared to 55 per cent of men. Even when the women were married with children, the number only rose to 55 per cent of women and 62 per cent of men. It also put women at risk of financial hardship in retirement due to the lack of long-term planning.

So what do Financial Planners need to do to encourage women to take a significant interest in their finances? Ms King said: “Women are hungry for greater financial education and information across a diversity of financial matters. Experts have reported that unless women fully understand a financial product, they will not engage with it.”