Half (49%) of retirees entered retirement without any clear financial plan for their post-work years, according to a new report.

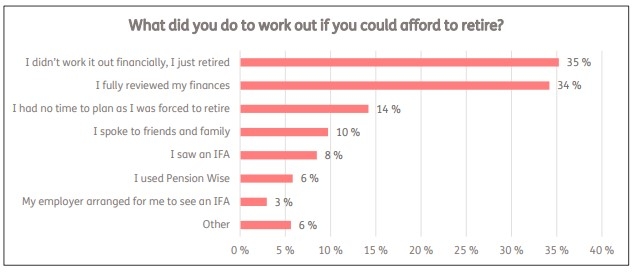

Over a third (35%) of retirees over 55 surveyed by Just Group said they retired without making any financial assessment of their ability to afford retirement.

A further 14% were forced to retire earlier than expected and said they “ran out of time” to make financial plans.

Less than one in 10 (8%) retirees sought the help of an independent financial adviser.

Stephen Lowe, group communications director at retirement specialist Just Group, said: “Receiving financial advice remains the gold standard for preparing financial plans ahead of retirement and, if possible, we’d encourage people to explore this option.

“It may be that your employer offers help, perhaps by making an introduction to a recommended IFA or even making a financial contribution towards the cost – so do check with them. The advent of the digital world means there are some lower cost online and hybrid solutions available for guidance or advice.

“At the very least people should make sure they take up their entitlement to use Pension Wise – the Government backed, independent and impartial service which provides free pension guidance.”

Just 6% of those surveyed by Just said that they had used Pension Wise.

Some people took a DIY approach and made their own calculations with over a third (34%) saying that they had conducted a full review of their savings looking at their likely incomings and outgoings.

A further 10% said that they had spoken with their friends and family for informal help and 6% had used other sources of support.

• Just Group surveyed 1,050 UK adults over 55 between 17 and 27 August.