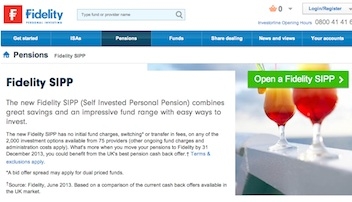

Fidelity Worldwide Investment is offering a one per cent cashback deal on transfers into the new Fidelity Sipp.

Transferring £10,000 or more into the new Sipp before 31 December 2013 means consumers could get up to £10,00 cash back.

Fidelity hopes this will encourage more people to combine their pension savings into one place.

The offer is available to anyone who submits a signed and completed pension transfer form to move their pension(s) from other providers to the Fidelity Sipp. The cashback received is equivalent to one per cent of the amount transferred.

Fidelity is also offering up to £300 towards the cost of exit fees when transferring from another provider.

{desktop}{/desktop}{mobile}{/mobile}

Mark Till, head of Fidelity personal investing, said ease, diversification and cost were all benefits of consolidation.

He said: "Having pensions in more than more than one place can make it difficult to keep track of savings and could lead to returns being lower than they should be. To make the most of their retirement savings, investors should consider consolidating old or multiple pensions into a single pot. Having all the information in one place would allow savers to see and manage their pension more easily.

"Savers should think about spending some time getting their retirement plans into shape and in particular think about whether they could do themselves a big favour by moving or consolidating old pension pot."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.