An investment firm has reported its ISA sales more than doubling since this time last year.

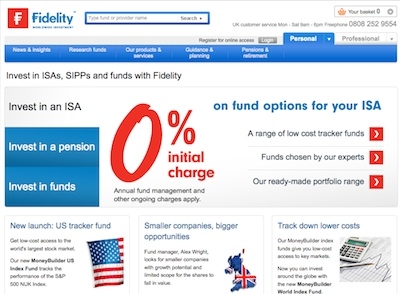

Fidelity Worldwide Investment said it has seen NISA sales rise sharply since New ISAs came into effect one week ago.

The report comes shortly after research suggested many people will be shunning the revamped savings account.

Nearly four in ten consumers do not intend to use the new individual savings accounts at all, a survey by True Prudential found.

Just 16 per cent said the launch of NISAs will make them more likely to save, despite the greater flexibility and simplicity.

The limit for a year was raised to £15,000 by Chancellor George Osborne as part of sweeping changes to savings announced in the Budget.

Mark Till, head of personal investing at Fidelity Worldwide Investment, said despite some scoffing that NISAs would be a 'damp squib' that only benefit the rich, they are proving a hit for investors.

{desktop}{/desktop}{mobile}{/mobile}

He said: "We have seen our ISA sales more than double compared to this time last year.

"We are delighted at the early signs that investors are keen to take advantage of the increased allowance and the flexibility of being able to now combine cash and funds in a single wrapper with Fidelity's NISA."

The limits for an investment ISA this tax year - £11,880 from 6 April then £15,000 from 1 July – are respectively five times and 6.25 times higher than the £2,400 limit of the first PEP scheme.

Mr Till said: "Given the pressing need to widen and deepen Britain's personal savings culture, you could say that this year's increases were long overdue. Still, the limits are up now and so is choice – and the good news is that savers are making the most of this.

"We are pleased to see that people are reacting positively to these new changes and are taking the opportunity to shelter even more from the tax man."

In addition to the increased allowance, investors now have the ability to hold cash and funds in a single wrapper on one platform, and move assets between them easily with no charge.