The number of younger people with ISAs dropped sharply from 2013 to 2014, new statistics have shown.

Analysis of HMRC data by Hargreaves Lansdown showed a 16% fall in the numbers of savers aged 25 or below subscribing to ISA accounts between the 2012/13 and 2013/14 tax year.

The drop off demonstrates the necessity of Lifetime ISAs, says Danny Cox, a Chartered Financial Planner at Hargreaves Lansdown.

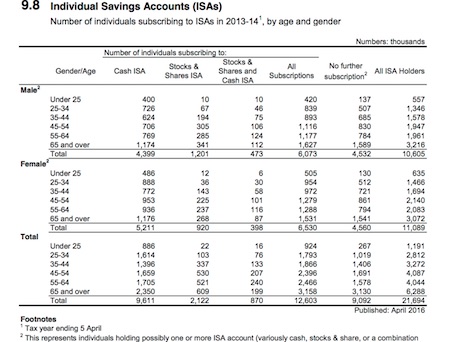

Overall the numbers of ISA subscribed to was down 4% to 21.694 million, according to the same analysis.

There were 557,000 male ISA holders under the age of 25 by April 2014, a fall of 18% from 678,000 the year earlier.

For women in this age group there was a 15% fall going from 744,000 to 635,000.

There was a 12% decrease for men aged 25-34, going from 1.532million to 1.346million, while there was an 11% drop for women, falling from 1.652m to 1.466m.

Source: www.gov.uk

Mr Cox expects data with the numbers of subscribers for the 2015/16 tax year to be available in August.

He said: “Falling numbers of younger ISA savers illustrates the necessity of introducing the right incentives through Lifetime ISA to encourage good longer term savings habits. The biggest fall amongst the under 25s reflects the increasing costs of university and rents at a time when wage growth was non-existent.

“Decisions made now during this consultation process will have a huge impact on its take up. Lifetime ISA incentives will be far more effective and the scheme far more successful if bonuses are paid monthly rather than the current proposal of up to 15 months in arrears.”

Other headline figures from the HL analysis were:

- The average ISA market value at the end of 2013/14 rose from 19,528 to £21,647.

- Average cash ISA value was £9,412 up from £8,616, average stocks and shares ISA value £44,320 up from £38,821.

- Those who hold both cash and stocks and shares saw average values rise from £48,311 to £52,857.