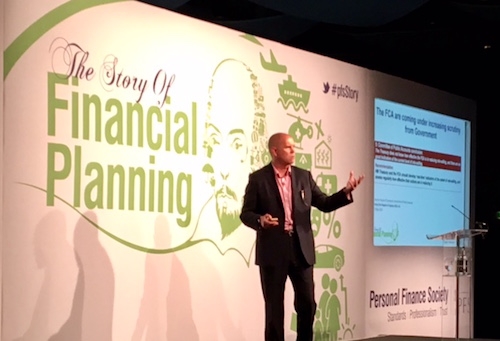

Former IFP chief executive Steve Gazzard has told today's PFS National Financial Planning Symposium in London that the advice gap could get worse without action.

Steve Gazzard, speaking about the future of Financial Planning, said he was sceptical about robo advice being able to bridge the gap as some had suggested but he believes it could bring down the cost of advice if it was integrated with human interaction as part of the Financial Planning process.

He told nearly 1,000 attendees at the event at London's Wembley Stadium today that there were major problems in reaching the mass market with good financial advice and in building sound savings plans. He fears profeessional financial advice could become more unaffordable and harder to find for consumers unless there is a vision for the profession to widen its appeal.

He said the problems included poor affordability, lack of consumer education and trust issues due to past mistakes. Many consumers were ignorant of even basic financial matters. He said: "20% of consumers could not find the balance on a bank statement, according to one survey."

His vision, he said, was a world where a true Financial Planning profession led the way in shifting the UK from a "debt culture" to a "savings culture." The profession needs to be united to achieve this and he backed PFS CEO Keith Richards who called for more unity.

He said: "We need a coherent savings strategy from the regulator, let's get some stability and lets build a savings culture not a debt culture. We need better education for consumers and we need to define Financial Planning more clearly so consumers understand it."

He said he believed that better relationships between employers and planners could help open doors to more people accessing good financial advice. He questioned whether the Pensions Dashboard would work.

On cashflow modelling, recently a contentious issue for the profession, he said: "I like cashflow as part of the process but it's not a product in its own right. I think it's right for most clients but not right for all clients. I'll get shot by some of my old colleagues for saying that."

A key issues for the profession in the future, he said, was understanding and challenging conflicts of interest. Financial Planners must act as fiduciaries, he said.

He said: "We need to make sure the client is first and we have a culture of challenge on conflicts which are often not acknowledged."

Mr Gazzard, director of S J Gazzard Consulting, has begun a series of talks giving his views on the path ahead for Financial Planning. He is speaking at all four PFS National Financial Planning Symposiums.