Troubled wealth manager WH Ireland has sold its Henley Financial Planning team to Verso Wealth Management for up to £500,000 and will close its Henley office.

Fast-growing Chartered Financial Adviser and wealth manager Shackleton, formerly Skerritts, has acquired Norfolk-based firm Harrold Financial Planning Ltd for an undisclosed sum.

In this regular column PFS director of policy Dr Matthew Connell looks at a pensions wrangle which may cause some pain.

The New Year began with painful headlines about thousands of members of the Teachers’ Pension Scheme who have been forced to put divorce proceedings on hold – sometimes for over a year – because of an administrative backlog in calculations to determine the Cash Equivalent Transfer Value (CETV) of their pension.

The delays were triggered by a judgement in 2018 on discrimination against younger members of public service pension schemes which required a new approach to calculations.

Whatever the rights and wrongs, it is impossible not to make comparisons with the standards in retail investment. Here, the Consumer Duty demands that standards of ‘consumer support’ must be high enough that ‘sludge practices’, such as delays to administrative processes, cannot be allowed to cause consumer harm.

In 2021, as the Consumer Duty was being introduced, the Personal Finance Society argued that: "FCA rules place some requirements on advisers that have no corresponding requirements for occupational pension schemes. We understand that the FCA cannot apply its Consumer Duty to pension schemes and other organisations that are outside its remit, however we think that the regulatory community, led by HM Treasury, should be taking action to deliver good outcomes for consumers and we do not think it is adequate that the regulators continue to allow poor outcomes to persist because issues have “fallen between the cracks” in the regulatory patchwork."

For the public, a pension is a pension. If one pension scheme fails to meet fundamental standards in one part of the sector, public confidence in all pension provision will suffer.

• This column first appeared in Financial Planning Today magazine, Jan-Feb 2025 edition. Matthew's column appears in each issue of the magazine. You can subscribe to the magazine by registering for this website and then checking subscription options in 'My Account.'

Dr Matthew Connell is director of policy and public affairs for the Personal Finance Society.

The Financial Ombudsman Service (FOS) is to begin charging claims management companies (CMCs) and professional representatives for submitting claims from April, it confirmed today.

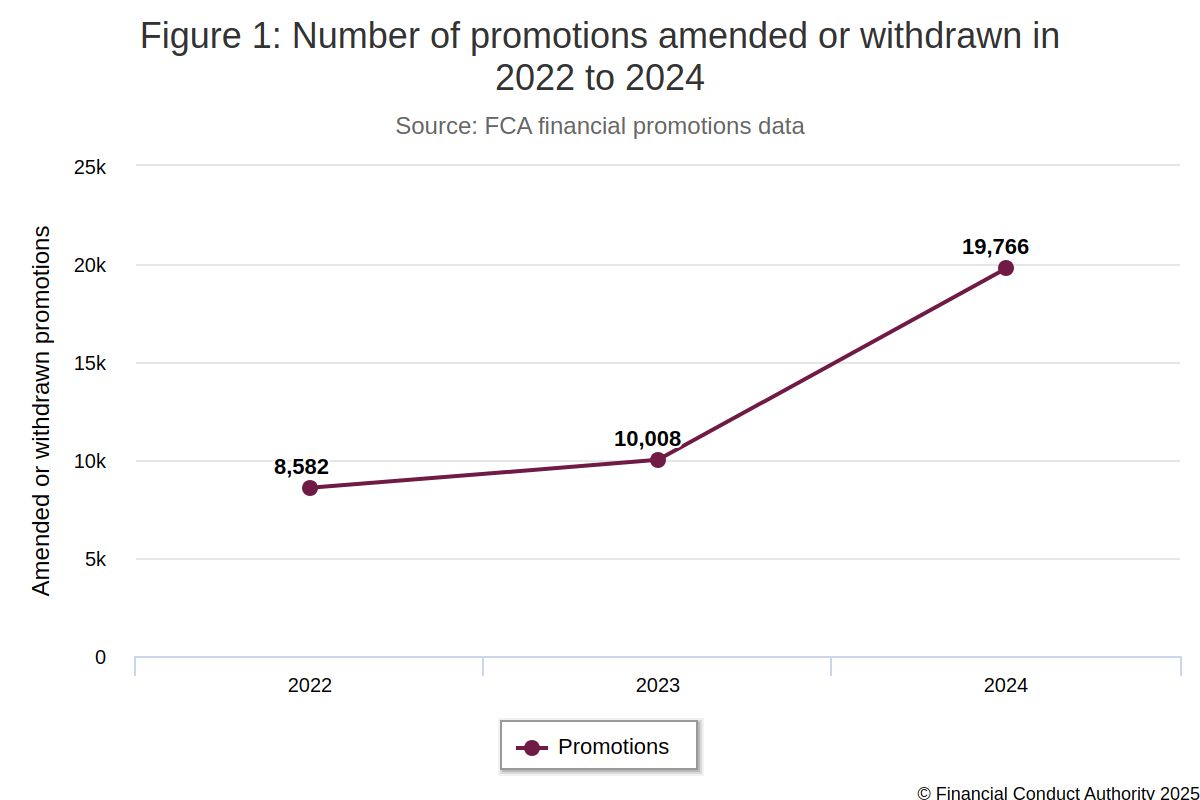

Latest data from the FCA published today has revealed that nearly 20,000 financial promotions were pulled or amended in 2024 following intervention from the regulator - almost double the level seen in 2023.

Abby Thomas, CEO and Chief Ombudsman at the Financial Ombudsman Service, has exited the organisation this week in a shock departure.

Last year saw net retail fund outflows of £1.6bn, compared to much larger outflows of £26.9bn and £24.3bn in 2022 and 2023, according to data from the Investment Association.

Derbyshire-based Financial Planning firm Belmayne has gifted over £8,000 to small local charities after a year of fundraising.

Four in five financial advice firms reported increased turnover in 2024, with two thirds anticipating higher profits in 2025, according to a new report.

The FCA has ruled out compensation or launching a criminal investigation into the £46m collapse of Blackmore Bonds despite complaints from investors.