The FCA has warned cryptoasset promoters they could face up to two years in prison and unlimited firms if they do not comply with new rules on the marketing of crypto which - it has confirmed -will begin on 8 October.

Liontrust shareholders have voted in favour of the takeover of Swiss rival GAM to form a £53bn AUM fund manager.

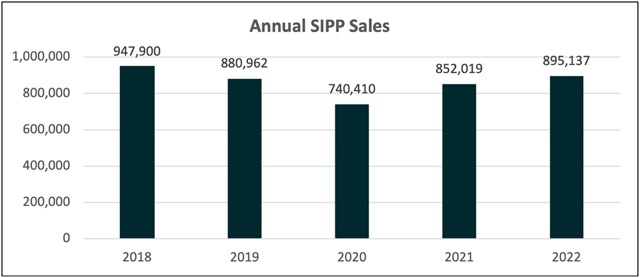

Sales of Self Invested Personal Pensions (SIPPs) bounced back in 2022 to reach nearly 900,000 new plans arranged - the highest level since 2018.

The Quilter Foundation, the charity arm of wealth manager Quilter, is partnering with social mobility charity The Brokerage to help more young people from socially-disadvantaged background find jobs in Financial Planning and the City.

Former Sesame Bankhall Group CEO Michele Golunska has joined the board of mortgage broker Tembo as a non-executive director.

Government Bonds were the top selling sector for fund sales in May, with net retail sales of £658m.

Octopus-owned investment platform Seccl has launched a fully digital and paperless drawdown SIPP.

National IFA firm Continuum has bolstered its St Albans team with the appointment of retirement specialist adviser Andreas Vazanias.

The Financial Conduct Authority has told asset managers to review liquidity management in their funds.

Workers in London and the East of England are saving 40% more than those in the Midlands and North, according to a new report.