Advice and Financial Planning assets grew 6.5% to £11.4bn at wealth manager and Financial Planner Mattioli Woods for the year ending 31 May.

The Financial Conduct Authority has confirmed it will raise its funding requirement for Financial Planning firms by 8.9% to £94.6m in 2023/24.

Due diligence fintech DD|hub has today launched an upgraded system to help advisers with the Consumer Duty requirements and help identify the 'foreseeable harms' that could affect clients when using providers.

The Department for Work and Pensions has launched a new 'Midlife' MOT website to help older workers with their 'Financial Planning' and careers options.

There has been a 142% increase in the number of additional rate tax payers since the tax bands were frozen in 2021, latest HMRC figures reveal.

The Financial Conduct Authority has banned Birmingham-based adviser Paul Steel of Estate Matters Financial Ltd (EMF) from working in financial services.

M&G Wealth has recruited Abrdn Personal Wealth CEO Caroline Connellan to be its new chief executive.

Expanding Chartered Planner HFMC Wealth has acquired London Chartered Financial Planner Weston-Cummins which has £350m in assets under advice (AUA).

The Financial Conduct Authority has received more than 600 applications to its regulatory sandbox since its launch in 2016.

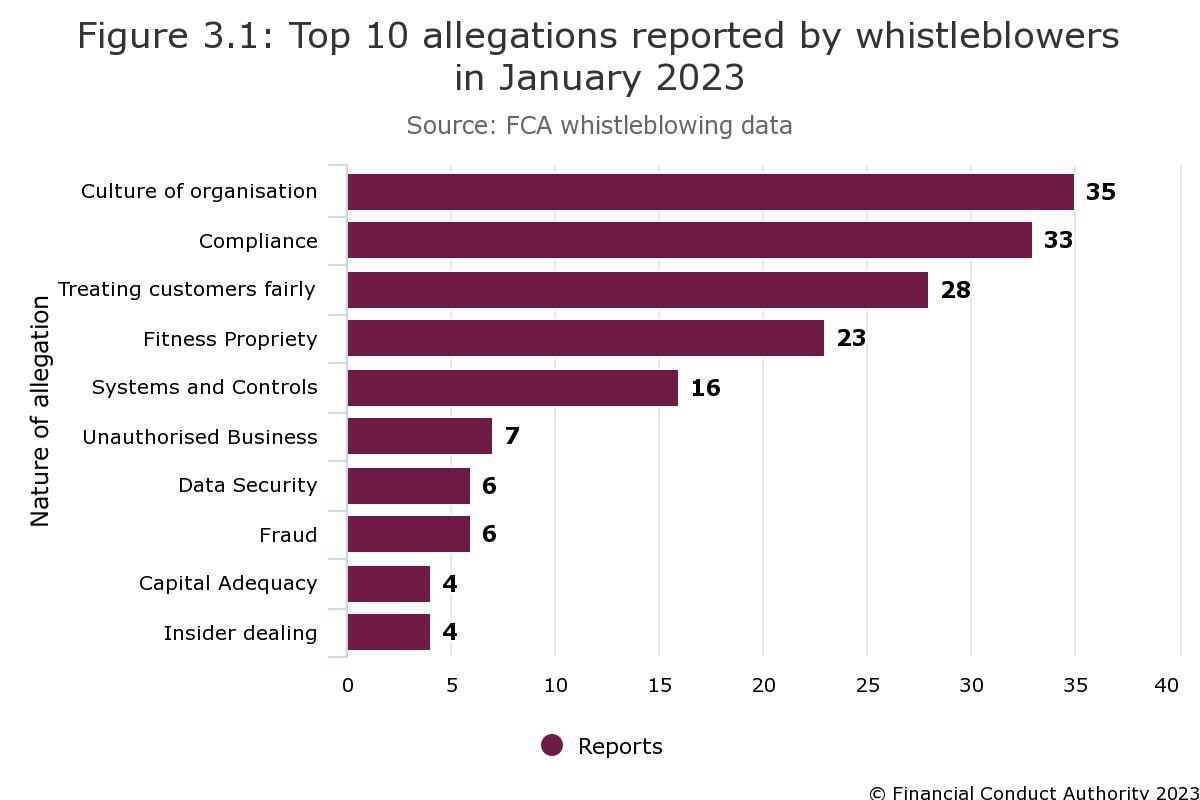

‘Fitness and propriety’ and ‘compliance’ were the joint top reasons for whistleblowers to complain to the FCA in March.