Chancellor Rachel Reeves is reportedly considering cutting the tax-free pension commencement lump sum in a bid to save more than £2bn a year for the Treasury.

HMRC has warned users of its Self Assessment system to remain vigilant to scams that claim to be from the department.

Those earning over £100,000 could face paying over £7,000 in extra income tax if the current freeze on tax thresholds - due to end in 2028 - is extended to 2030, according to a new report.

Aegon’s adviser platform saw a drop in net outflows to £1,447m in the first half of 2025.

The Society of Pension Professionals has called for pensions automatic enrolment to be extended to the self-employed.

HMRC collected inheritance tax (IHT) receipts of £3.1bn in the first four months of 2025/26, an increase of £229m (8%) compared to the same period in 2024/25 (£2.8bn).

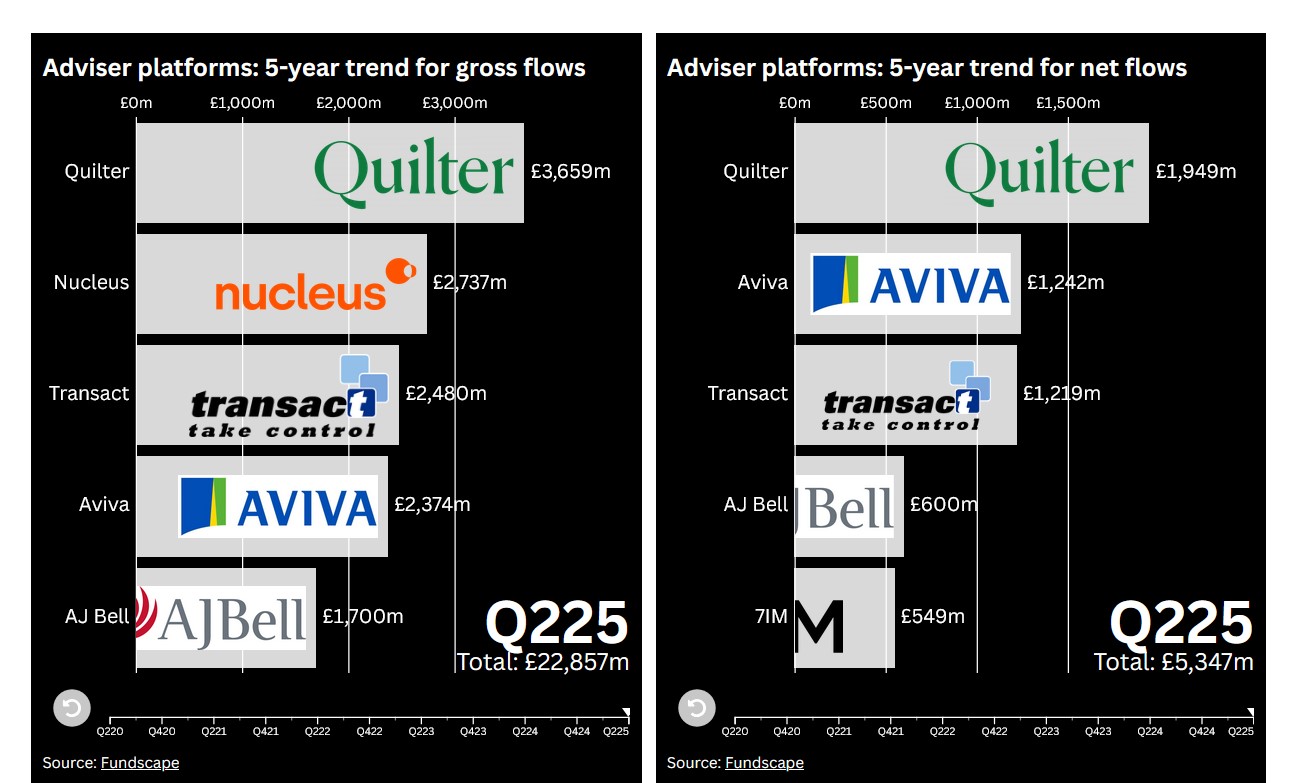

Adviser platforms reported their strongest quarterly net sales figures in three years in the second quarter, according to new data.

Six people are to appear in court today over a pension fund and SIPP fraud which involved £75m being invested into storage units in the North of England and Scotland.

Hoxton Wealth has launched a three-year Financial Planning training programme called the Financial Planner Pathway.

675-member Waltham Forest Council Employee Credit Union Limited (FRN: 213408) has gone into administration and been declared in default by the Financial Services Compensation Scheme (FSCS).