Financial Planning tech firm Wealth Wizards has revealed it is developing software that will enable financial advisers to implement a digital ‘abridged advice’ service.

It came in response to the FCA’s proposal in July for ‘abridged advice’, a lighter form of DB pension transfer advice which cannot recommend a client to transfer.

The Wealth Wizards tool is scheduled for an early 2020 release and will integrate with existing back-office platforms as well as existing Turo modules.

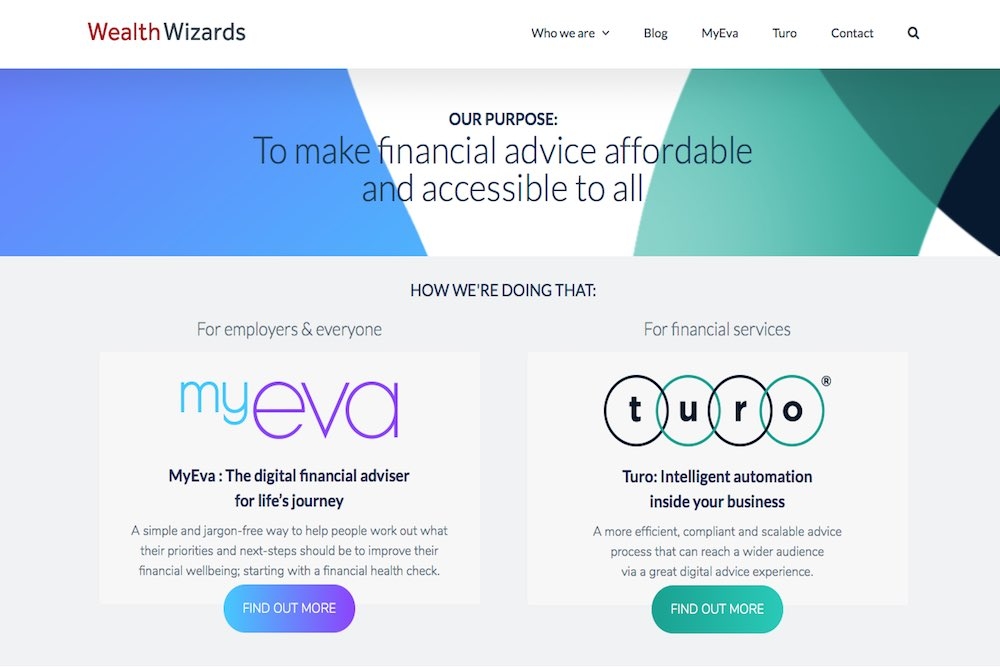

Turo is Wealth Wizards’ ‘advice engine’ which automates key processes within the advice cycle, such as fact-finding and the production of suitability reports.

It will enable financial advisers to automatically filter out clients who are unlikely to be recommended for transfer without requiring the time and expense of a full advice service.

The new digital service will be part of a three-stage DB solution, fitting in with existing Turo modules.

The firm says stage one comprises in-depth education and guidance and stage two is digital abridged advice.

Stage three is the full advice service for those clients who are deemed suitable for a DB transfer; this module is part of Turo for Advisers “which helps advisers automate much of the ‘heavy lifting’ when it comes to delivering financial advice”.

Tony Vail, co-founder and chief innovation officer for Wealth Wizards, said: “Our abridged advice tool will save firms keen to stay compliant while avoiding an even heavier workload after the FCA’s July paper.

“The abridged advice module will take those seeking advice straight to an education portal, where they can get clued-up, often for the first time, on the potential pitfalls of transferring out and what the process might entail for them.

“They will then go on to complete a questionnaire of no more than about 20 questions, before receiving compliant advice or signposting for next steps.”

Andrew Firth, Wealth Wizards’ co-founder and CEO, said: “Turo’s abridged advice module will help advisers offer consistent and compliant responses quickly and efficiently.

“We have shared the idea with several firms and there is interest from several parties, which has only spurred us on to take the software right through to the testing stage and beyond, so we can put it out there as soon as we can and help advice firms pre-empt any forthcoming legislation.”