Some 46% of firms in the financial services sector have increased their staffing numbers in recent months, according to the latest survey by the CBI and PwC Financial Services.

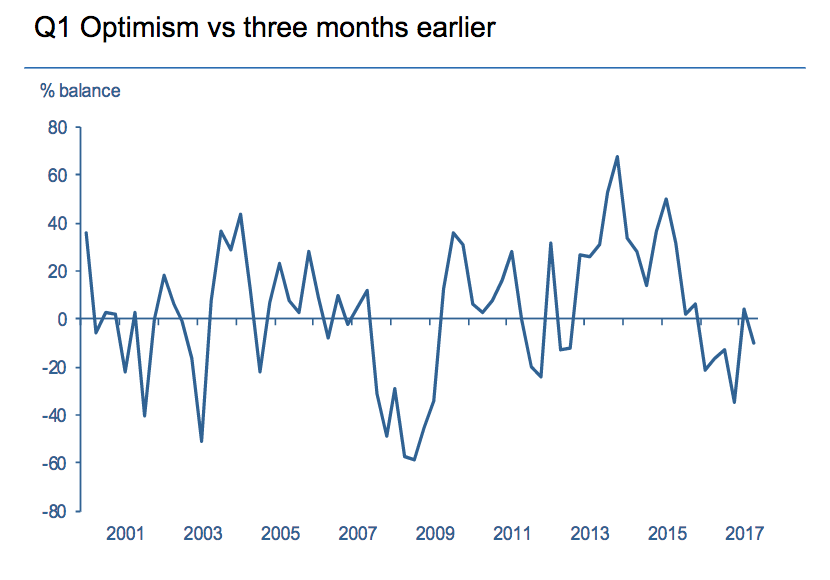

However, the news comes at a time where the financial services sector is feeling less optimistic about the overall business situation in the future, with optimism decreasing for the fifth time in six quarters.

The quarterly survey of 94 companies, carried out on 8 June, found that 46% of financial services firms had increased employment in the previous quarter with 25% of employers expecting an increase expected in the next quarter.

Despite this, 17% of firms said they had decreased their employment numbers.

The survey also found that the financial services sector was feeling less optimistic about the overall business situation, however, this was not a feeling which was universal.

While banks and life insurers were feeling less optimistic compared to three months ago, investment managers, insurance brokers and finance houses were feeling more encouraged about the overall business situation.

Business factors such as business volumes and profits saw ‘robust improvement’ according to the survey, with this being driven by demand from private and corporate clients.

Additionally, rising business volumes, combined with a slight fall in average costs, led to a second successive quarter of improving profitability. Profitability is also expected to rise further in the next three months, though at a more moderate pace.

The authoritative survey by CBI/PwC Financial Services also found that the financial services sector was at the forefront of adopting new technologies to gain customer insights. Almost two thirds of firms are increasing operational data analysis, while half are investing in process automation.

In the year ahead, financial services firms expect to increase IT spending at the fastest pace since December 2015, however, they are expected to cut back on other forms of capital spending.

Rain Newton-Smith, CBI chief economist, said: “The robust performance of financial services firms over the last quarter gives us a good dose of summer cheer. Volumes continue to expand strongly, profits are up and more people are being hired in a thriving part of the British economy. Even better, that is all set to continue over the next three months.

“But there are mixed messages coming from the sector. Whilst business activity is holding up strongly, optimism took another dive, which likely reflected a mix of Brexit uncertainty and concerns that financial market conditions could tighten.

“It’s encouraging to see financial services firms continuing to seek out future opportunities, and staying ahead of the curve when it comes to investment in new and innovative technologies.”

Andrew Kail, head of financial services at PwC, said: “The counterweight of short-term performance against medium-term outlook explains the sentiments expressed by financial services companies this quarter.

“Currently the financial services sector is performing well in both business volume terms and underlying profitability. However, another quarter of falling optimism points to an industry harbouring concerns about the future.

“The UK will continue to be a leading financial centre, but political uncertainty and the ongoing wait for an agreed Brexit blueprint are fuelling more questions about companies’ futures and the performance of the wider economy.”