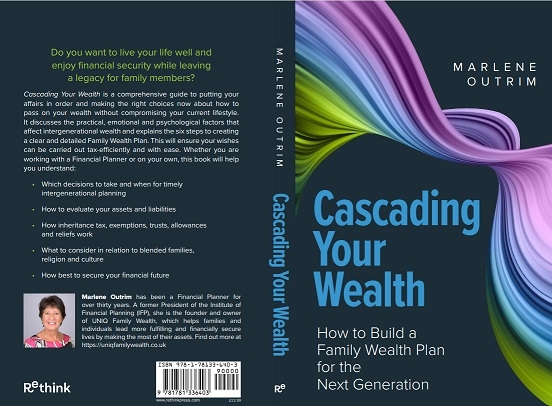

Longstanding Financial Planner Marlene Outrim is to publish a new book on intergenerational wealth transfer.

'Cascading Wealth' gives insights into how best to pass family wealth through the generations.

The book is due to be published this month.

The book is her second, having previously published Boomers Redefining Retirement in 2018.

Ms Outrim is a former President of the IFP, which is now merged with the CISI.

She is a Financial Planner with over 30 years’ experience, and is known as a pioneer for change. She is managing director of the Cardiff-based Financial Planning firm she founded called UNIQ Family Wealth.

Ms Outrim was an early adopter of Financial Planning and cashflow modelling and has been an advocate for Financial Planning for many years.

She started writing the book 18 months ago as more and more clients were looking at estate planning and passing on wealth.

When talking through family dynamics and personalities with clients, she realised that intergenerational wealth transfer was a process individual to every family, with many complexities.

The target audience for the book are the Boomer generation, many of whom have excess wealth due to benefiting from increasing property values, DB pensions and high state pensions.

As this generation becomes older, Ms Outrim noted they are spending less and that many were starting to come to the point where they were thinking about what to do with excess wealth.

Ms Outrim told Financial Planning Today that she believes the book can help less experienced Financial Planners have the initial conversations with their Boomer clients on complex areas such as blended families or where a couple has different views.

She said by recommending the book to clients, it can help Financial Planners deal with the, “more sensitive or even taboo subjects” as well as helping encourage clients to get their whole families involved with intergenerational wealth transfer.

She said: “You have to understand the family dynamics: who takes the lead, who controls the money, what are everyone’s goals and objectives, are there any health concerns etc. They are sensitive discussions but discussions that need to happen.”

Ms Outrim believes her previous career as a probation officer has helped her with understanding family issues, which has come in helpful when it comes to planning for intergenerational wealth transfer.

She also noted that it is important for Financial Planners to remind clients not to forget their own needs.

She said: “First and foremost clients need to think about how they want to live the rest of their lives, do they have enough money put aside for possible future care needs or for a surviving spouse should one die. Then you can think about aspects such as inheritance tax.”

Ms Outrim's firm UNIQ made the headlines earlier this week with plans to move to a four day working week from January.

The firm will close its offices on Fridays from January to give staff a three day weekend.

UNIQ says it is not extending the length of working days from Monday - Thursday, or cutting pay. People will simply work 20% less across the week.

Ms Outrim said the move follows consultation with staff and was driven by a desire to give employees additional time to spend with their families.