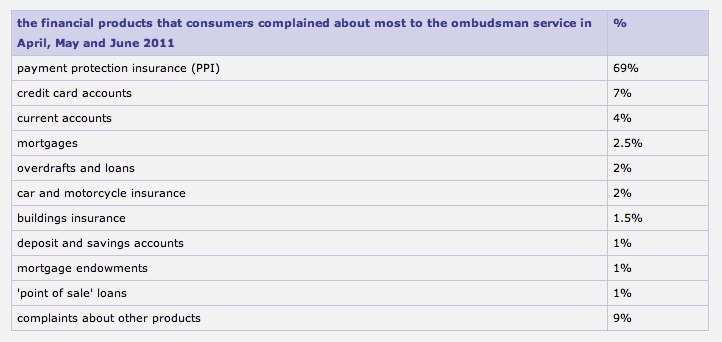

Payment protection insurance accounted for 69 per cent of new complaints to the Financial Ombudsman Service this quarter.

Figures released this week show the total number of complaints for April, May and June 2011 broken down by sector.

FOS received 56,025 new cases relating to PPI in the last three months. This is the equivalent of 900 new cases each working day. The Ombudsman upheld over half of these cases.

For the same period in 2010, FOS only received 39,576 complaints.

However this latest period covered the High Court decision on the PPI judicial review and the decision by the British Bankers’ Association not to appeal that decision which is likely to have accounted for the sharp increase.

The PPI scandal involved customers being mis-sold PPI which they either didn’t ask for or were not eligible for.

Tony Boorman, principal ombudsman and decisions director, said: “During the period of that judicial review, our ability to progress cases against many banks and other financial businesses was seriously hampered, meaning that fewer cases than we had planned were resolved.

“That had an impact on the ‘uphold rate’ as inevitably it was the cases that we thought we should be upheld that proved most difficult to finalise.”

The total number of complaints received by FOS stood at 81,301 with 49 per cent being upheld. Some seven per cent, 5,500, were related to credit card accounts and four per cent, 3,201, were related to current accounts.

FOS expects the second half of this year to be challenging as banks will be dealing with cases received after the review.

Mr Boorman said: “There is no dispute that banks should be following the ombudsman’s approach and the FSA’s complaints-handling guidance.”