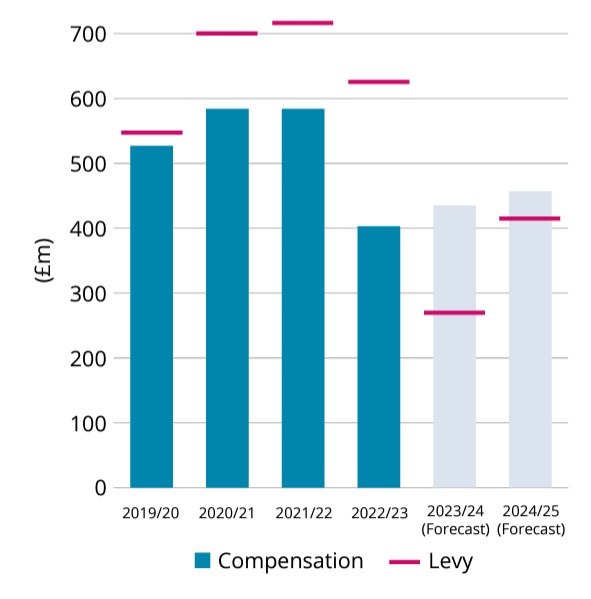

The total levy to pay for the cost of the Financial Services Compensation Scheme is set to soar by £145m from £270m this year to £415m in 2024/25.

Advisers could face a near 40% rise in their levy as a result.

For the Life Distribution and Investment Intermediation (LDII) class, which covers most advisers, the FSCS is forecasting a near 40% levy increase next year (2024/25) to £140.4m (2023/24: £101.1m).

However, the FSCS points out this is lower than previous years. For example in 2022/23 the LDII class levy was £213.1m and in 2021/22 it was £240m so the exact impact is uncertain.

The FSCS today published its forecasts for the levy in its Outlook publication.

The levy is paid by financial services firms, including financial advisers, to meet the cost of compensation claims from consumers related to failed firms.

Despite the large rise in the levy forecast it is too early to predict the exact impact on advisers and providers although it looks likely that advisers may face a hefty increase next year.

The FSCS warned that the compensation bill was rising due mainly to poor financial advice and legacy insurance provider failures causing more “complex” claims.

This year’s levy forecast for the current 2023/24 year remains unchanged at £270m. The current total compensation bill forecast for this year - £435m - remains broadly in line with forecasts in May and the FSCS says it does not expect to impose any additional levies on firms during this financial year.

The levy impact this year was reduced by using reserves from previous years but it is not yet know what reserves might be available to lessen the impact of the 2024/25 levy, the FSCS said.

The £435m figure for this year’s claims is a £36m reduction from the last forecast published in May driven mainly by fewer claims decisions than anticipated in the Life Distribution & Investment Intermediation (LDII) class. There were a number of reasons for this, including changes to how pension redress is calculated and third-party response times to enquiries, the FSCS said.

Any surpluses in each class will be carried forward and used to offset the levy payable by firms in 2024/25, the FSCS said.

The current forecast for the next financial year, 2024/25, is £415m. The FSCS has stressed this was an “early indication and subject to change.”

Expected compensation costs are estimated to be approximately £457m during 2024/25.

FSCS Compensation and Levy 2019-2025

Source: FSCS

The FSCS says that although the levy is expected to increase in 2024/25, due to the lower surpluses carried over from the previous financial year, compensation costs remain “relatively stable” overall. For the most recent three years, including the forecast for 2024/25, the annual compensation bill is between £400m and £460m.

FSCS interim chief executive Martyn Beauchamp said: “From a claims perspective, we have seen recent trends continuing. Most of our compensation continues to be paid out for poor financial advice and for legacy insurance provider failures - both of which include some of the most complex defaults and claims we handle.

“As referenced in previous Outlook updates, this continued complexity means we are always evolving our processes and structures so we can continue making accurate and efficient compensation decisions for our customers. Over the coming months, my key focus will be ensuring FSCS is well-positioned to remain a trusted, effective and future-fit compensation service.”

He added that more than 80% of the total compensation forecast for 2024/25 relates to firms that have already been declared in default.

PIMFA welcomed the FSCS predictions, but said the levy still penalises well-run firms.

Simon Harrington, head of public affairs at PIMFA, said: "Broadly, while the levy forecast for 2024/25 is lower than in previous years, indicating lower levels of consumers who have been let down, it remains the case that it is an uncontrolled cost to firms and penalises well-run firms for the failures of others.

"While we recognise that this represents a stabilisation of the cost of funding the FSCS, we remain of the view – given the likelihood of future claims working their way through the system – that FCA fines to be used to subsidise the FSCS levy, rather than being directed towards the Exchequer would represent a much fairer system and truly represent a polluter pays model the entire financial services industry agrees on. This is the fairest way to ensure consumers get the protection that they need whilst lifting a considerable burden on firms."

• The full FSCS report is available at www.fscs.org.uk/Outlook - pages 25 and 26 are for the LDII class.