The Financial Services Compensation Scheme paid out over £326m in compensation to over 85,000 consumers during 2012/13.

According to its report this week, the FSCS received 62,030 new claims in 2012/13.

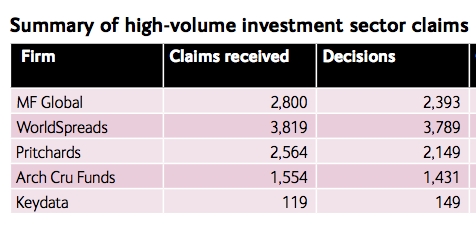

The FSCS said this was down 36 per cent on the 96,900 claims in the previous year but that the complexity of cases had increased due to failures in the investment sector.

Investment sector cases require the FSCS to analyse a firm's potential liability to investors and policyholders, value the products in a firm's portfolio and quantify the number of claims.

A total of £105m was paid out in compensation for the investment intermediary sector but this was down from £108m in 2011/12. Some £30m was paid out in compensation for MF Global, £25m for Arch Cru funds and £16m for WorldSpreads.

{desktop}{/desktop}{mobile}{/mobile}

Claims related to payment protection insurance policies accounted for 40 per cent of total claims.

Investment intermediaries had to pay a £20m interim levy earlier this year due to the high volume of investment claims but the organisation said it did not expect high levels to continue into 2013/14.

Chief executive Mark Neale said: "FSCS must become more capable in its day-to-day operations so that it can successfully manage the many highly complex issues that arise when firms fail. FSCS must be ready to protect consumers in the event of major failures in the future.

"This means ensuring that our capability to pay out compensation to consumers can scale-up to meet greater demands than we faced in 2012/13, while being able to participate in innovative resolution arrangements when these offer a better outcome for consumers and save costs."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.