The FCA is to implement a package of reforms after accepting the findings of the long-awaited Gloster Report that it failed to adequately protect the 11,625 investors who lost money due to the £236m collapse of mini-bond provider London Capital & Finance.

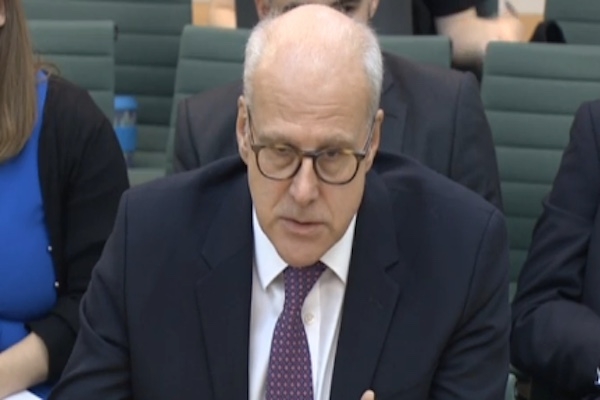

FCA chair Charles Randell said the regulator was “profoundly sorry” for failing LCF customers.

The damning 480-age report by Dame Gloster found that the FCA failed to fulfil its statutory function to protect investors.

The FCA will also accept “lessons” from its regulation of another failed investment, Connaught Income Fund Series 1 and connected companies.

The Gloster Report, published today, reveals a wide range of weaknesses and failings at the FCA over the regulation of LCF.

Dame Gloster was asked by the FCA and Treasury last year to conduct an investigation into the high profile collapse of LCF.

Dame Elizabeth Gloster’s Report said: “The Investigation has concluded that the FCA did not discharge its functions in respect of LCF in a manner which enabled it effectively to fulfil its statutory objectives.

“In all the circumstances, the investigation concludes that the bondholders, whatever their individual personal circumstances, were entitled to expect, and receive, more protection from the regulatory regime in relation to an FCA-authorised firm (such as LCF) than that which, in fact, was delivered by the FCA.”

She found:

• Significant gaps and weaknesses in the FCA’s policies and practices

• “inadequate regulation of LCF”

• The FCA’s “flawed” approach to its regulatory perimeter resulted in LCF being able to use its FCA-regulated status to present an unjustified ‘imprimatur’ of respectability to the market, even in relation to its non-regulated bond business.

• The FCA.. failed to question, in any meaningful way, whether LCF might have obtained, or used, its FCA-authorised status in order to attract investors to its unregulated bond business.

The Financial Services Compensation Scheme has so far paid out just over £50.9m in compensation to LCF customers but continues to deliberate on whether many claims are outside its remit.

FCA chair Charles Randell said: “There are a number of things we could have done better in our supervision of these two firms (LCF and Connaught) and both reports highlight the need for the FCA to continue to change to better protect consumers from harm.

“We accept all the recommendations that have been made to the FCA and we are profoundly sorry for the mistakes we have made.

“The collapse of LCF has had a devastating effect on many investors and we will do everything we can to conclude our investigations as quickly as possible and support the recovery of further funds for investors.”

• The report and FCA response can be viewed here: https://www.gov.uk/government/publications/outcome-of-investigation-into-the-fcas-regulation-and-supervision-of-lcf