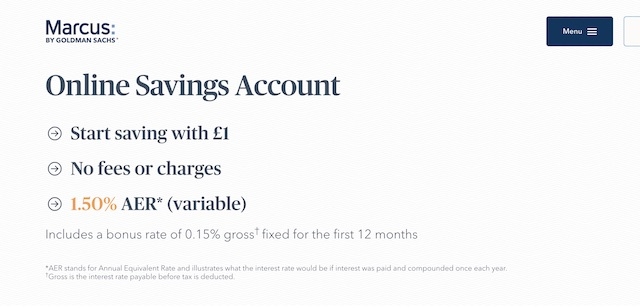

Goldman Sachs’ new online bank Marcus is launching its first savings account in the UK with a market-beating 1.5% on offer.

The rate trumps other easy access accounts available but includes a 0.15% bonus only guaranteed for 12 months.

Commentators believe the move will put pressure on other banks and deposit takers to compete by raising savings account rates.

The new Marcus Online Savings Account has no fees or charges and accounts can be opened for £1. The maximum savings amount at present is £250,000.

Marcus, named after Marcus Goldman - one of the founders of Goldman Sachs, plans to offer “a consistently competitive interest rate.” Goldman Sachs has offered a consumer savings account in the US since 2016.

Accounts are available to UK residents over 18 and money can be withdrawn or deposited at any time.

The account is managed online but telephone support is available from a UK-based customer care team on week-days.

Des McDaid, managing director at Marcus by Goldman Sachs, said: “Over the last decade savers have been on the wrong end of low interest rates.

“We’ve spoken in-depth to people across the country and there is a real disillusionment about savings – while most UK adults are diligently trying to save every month, some do not even have a savings account, with low interest rates and complexity being put to blame.

“We want to reverse the trend – literally putting the interest back into savings and make saving worthwhile again.”

“We’ve made the Marcus Online Savings Account as easy as possible to open and manage online, and with our aim to offer a consistently competitive interest rate, we hope our customers will see the benefits - and how, over time, this can add up to help them get to their saving goals that bit quicker.”