Platform HANetf is celebrating its first anniversary this month.

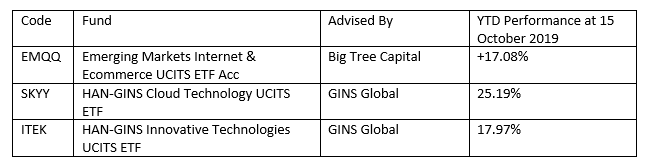

It marks 12 months since the launch of its first three ETFs:

The first three funds all follow indexes with technology-related slants in both emerging and developed markets.

The firm says they represent a recognition of the important role played by technology companies in the growth of the global economy.

All three funds are up over 15% year to date.

EMQQ is also outperforming the MSCI Emerging Markets Index by almost 10% (MSCI EM +7.69% YTD basis to 15 October).

EMQQ tracks an index of leading Internet and e-commerce companies that serve emerging markets, including search engines, online retailers, social networks, online video, online gaming, e-payment systems and online travel.

HAN-GINS Cloud Technology (LSE: SKYY) tracks the Solactive Cloud Technology Index and seeks to provide exposure to companies active in the field of cloud computing such as service providers or producers of equipment or software focused on cloud computing.

HAN-GINS Innovative Technologies (LSE: ITEK) tracks the Solactive Innovative Technologies Index and seeks to provide exposure to Industry 4.0. These are the companies poised to benefit from the ‘fourth industrial revolution’ – including robotics and automation, Big Data, cyber security and future cars.

Since opening for business, HANetf has helped to launch two further ETF strategies – KMEFIC FTSE Kuwait Equity and HAN GINS Indxx Healthcare Innovation – and said it has more in the pipeline.

It recently announced a partnership with the UK’s Royal Mint to launch a gold bullion-based ETF in 2020.

HANetf funds are now available on more than 60 platforms including intermediary/wrap and online platforms like AJ Bell YouInvest, Barclays Smart Investor and Charles Stanley Direct.

The firm is also working with 14 APs, including Commerzbank, HSBC, Morgan Stanley and Societe Generale.

The Irish UCITS funds have also now been registered for distribution in six European markets, including the UK, Ireland, Italy and Germany.

HANetf was founded a year ago by Hector McNeil and Nik Bienkowski.

Mr Bienkowski said: “HANetf was founded with the vision of facilitating the launch to market of innovative ETF products that would meet investor demand.

“It forms a pathway for fund managers and other potential market participants who have interesting new approaches to investment, and who might lack the resource to make a successful ETF launch a reality.

“We have supported the launch of five ETFs since we opened our doors.”

Mr McNeil added: “It has been gratifying to see the reception we have had for our first three ETFs and we look forward to working with our existing and future managers, helping them to get further traction in the European market and further afield.

“These launches are also helping to broaden the range of ETF choices now available to investors and intermediaries in the European market, and the industry continues to mature.”