Thames Valley-based wealth manager and IFA Woodward Financials has launched an ‘enhanced advisory service’ for clients which offers daily risk monitoring of portfolios.

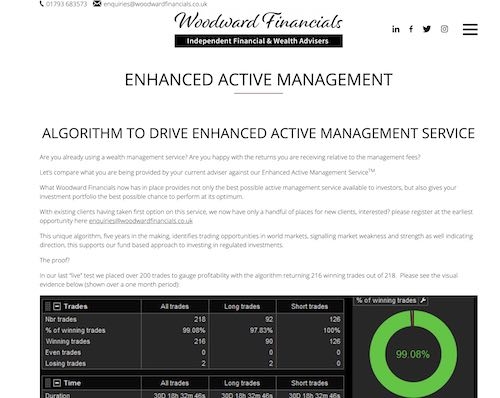

The firm says its new ‘Enhanced Active Management Service’ is based on an algorithm which has taken the company five years to develop.

The service identifies “trading opportunities” in key global markets and advises clients when investment changes are appropriate and when a change to their risk profile should be considered.

It is an optional upgrade to its standard advisory service.

The AMC (annual management charge) for the enhanced service is 1.25% per year compared to its standard AMC of 1%.

When fund and other charges are added the maximum annual fee for clients, depending on the model portfolio chosen, is likely to be a maximum of 2.25%, the company says.

Woodward said its new service is aimed at clients willing to pay more for an enhanced service and the possibility of better returns using the trademarked algorithm.

The minimum recommended investment is £100,000 and portfolios are monitored daily with human intervention to advise clients when fund changes are needed.

The service is also being offered to other advisers.

The Enhanced Active Management Service uses a rules-based programme with the use of trading software and a “manual decision process” to determine the trading of investments.

David Woodward, managing director of Woodward Financials and a former stockbroker, told Financial Planning Today the service was aimed at clients who wanted a fuller service with more frequent management of investments. He said most clients had signed up to the new service and understood they may be contacted more frequently when portfolio changes were needed. Their approval is needed before major changes are made to portfolios.

He has taken on additional staff to monitor and run the new service.

He said: “To remain compliant, we need to understand a client’s attitude to risk on an annual basis, or if their situation changes throughout the year. This would be the maximum risk profile allocated to the client and will need to be confirmed in writing or by electronic signature request.

“We will use our algorithm every day to monitor global markets and keep abreast of events that could affect portfolio direction. If we believe one or more markets are likely to be affected, we will alert all advisers to recommend to clients either a reduction or increase in risk for that particular sector/market.”

Woodward Financials has offices in Windsor, Newbury, Swindon and Cheltenham.