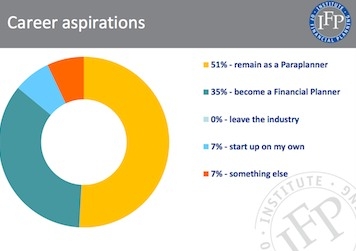

The Institute of Financial Planning has found only 35 per cent of Paraplanners intend to progress to becoming Financial Planners.

The research, which questioned 57 Paraplanners, found the majority wished to remain a Paraplanner or to set up their own Paraplanning firm.

While Paraplanning may have traditionally been a route into Financial Planning, the role is being seen as a profession in itself and more Paraplanners are progressing to become senior Paraplanners or technical specialists.

Paraplanners were also gaining more qualifications such as the Certificate in Paraplanning or Certified Financial Planner status in order to be as qualified as their Financial Planners colleagues.

The research also questioned respondents on the nature of their firm. Only seven per cent of Paraplanners were working for outsourced companies while 91 per cent worked in-house.

While outsouricng has grown over the past few years with companies such as Para-Sols and Paraplan Plus, it seems it is still very much in the minority.

Survey results also showed almost half of Paraplanners were aged between 25-34 and worked for companies with fewer than five employees.

Some 26 per cent worked for firms with between 11-25 people and 18 per cent worked for firms with more than 26 employees.

Almost 80 per cent of these firms used cash flow modelling, a key part of the Financial Planning process which the IFP is trying to promote.

Regarding wages, 23 per cent earnt between £30,000- £34,999 while seven per cent earnt £40,000-£45,999. Some 11 per cent of Paraplanners questioned earnt less than £20,00.

Over 90 per cent of Paraplanners were a member of a professional body, 40 per cent of whom were members of the IFP.