Net retail sales for Investment Management Association members fell in July to the lowest level since October 2008.

Sales totalled £936m, far below the monthly average of £2.3bn for the previous twelve months.

It also saw the lowest net Isa sales since February 2009 with net outflow of £29m compared to a monthly average inflow of £186m.

Equity funds similarly saw net outflows for the first time since February 2009 with net retail sales of £-114m compared to a monthly average of £676m net inflow.

These net outflows from UK, European and North American funds outweighed any inflows into Global, Japanese and Asia-Pacific funds.

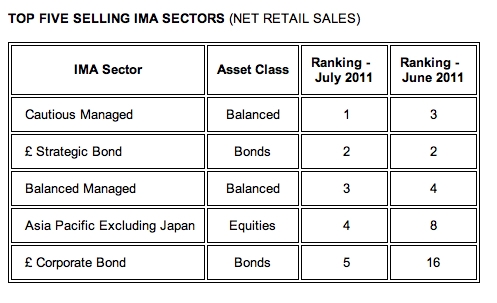

In terms of fund sectors, Cautious Managed regained its popularity to be the best selling sector for July with net retail sales of £216m.

The sector fell in popularity in June, in favour of Global funds.

The Strategic Bond sector was the second most popular with £156m in net retail sales.

The Corporate Bond sector also saw strong growth and entered the top five selling sectors for the first time in nine months.

Funds under management totalled £596bn, down from £601bn in June.

Richard Saunders, chief executive at the IMA, said: “In July, net retail sales fell to levels last seen three years ago. While sales of bond funds and balanced funds held up moderately well, equity funds experienced outflows, particularly from UK, European and North American sectors.

“At this stage it is too soon to speculate on whether these figures, which predate August’s market volatility, presage a shift in investor behaviour or are simply a one-off.”