Investment advice regarding income drawdown tops the list of queries clients have been asking over the last year relating to the pension changes, advisers have said.

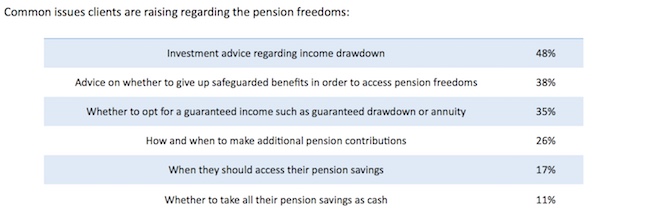

Just under half (48%) of the 250 advisers polled by Censuswide on behalf of Aegon said income drawdown was a common issue raised by clients.

Beneath this, it was followed by advice on whether to give up safeguarded benefits in order to gain access to pension freedoms (38%), whether to opt for a guaranteed income such as guaranteed drawdown or an annuity (35%), and how and when to make additional pension contributions (26%). These were the top issues up until September, when surveyed.

The research showed that for 61%, pension freedom changes were the top issue they had been dealing with over the past year, followed by investment planning (44%) and IHT planning (22%).

Steven Cameron, regulatory strategy director at Aegon UK, said: “The pension freedoms have presented those at retirement with welcome new choices on how to access their savings, but they’ve come hand in hand with greater complexity.

“Some decisions like transferring from a Defined Benefit scheme, can only be made with professional financial advice.

“Others such as choosing between guaranteed drawdown and an annuity, or deciding where to invest assets are important decisions, can also have huge impacts on people’s retirement income, and should be supported by the insight that professional advice provides.

“With the Treasury due to announce its initial conclusions from the Financial Advice Market Review (FAMR) around the Budget, we have a real opportunity to find ways of extending valuable advice to a wider range of customers grappling with retirement choices.”