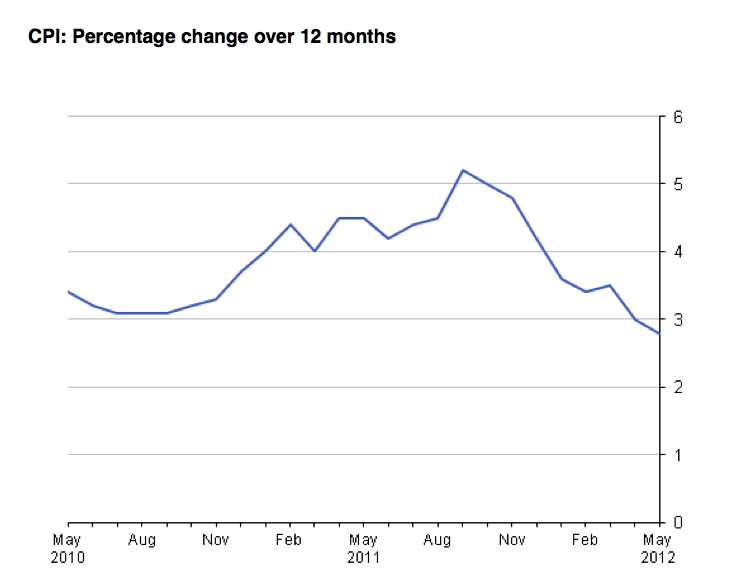

Consumer prices index (CPI) inflation fell from 3.0 per cent to 2.8 per cent in May, the lowest rate since November 2009, according to the Office for National Statistics.

Retail prices index inflation (RPI), which includes mortgage payments, fell from 3.5 per cent to 3.1 per cent.

The largest downward pressure came from motor fuels, fuels and lubricants fell by 3.1 per cent, and food and non-alcoholic beverages which rose by 0.3 per cent compared to a rise of 1.3 per cent in the same period last year. Recreation and culture fell by 0.4 per cent, particularly from audio-visual equipment and games, toys and hobbies.

The largest upward pressures came from air and sea transport which rose by 2.5 per cent with figures still affected by the timing of Easter.

The figures will be good news for the Bank of England which had expressed doubt in April about the time inflation was taking to fall, especially if it wishes to carry out more quantitative easing.

The Bank is hoping for inflation to have fallen to its two per cent target by the middle of 2013, revised from the earlier forecast of the end of this year.

Stephen Jones, joint head of fixed income at Kames Capital, said: “Slowing growth and falling demand globally appears to be feeding through into lowering UK inflation faster than forecast.

“Overall the cloud of poor economic news on growth and confidence has a silver lining in slightly better than expected inflation data- albeit inflation still remains above the Bank of England’s two per cent objective.”

The next inflation figures will be published by the ONS on 17 July.