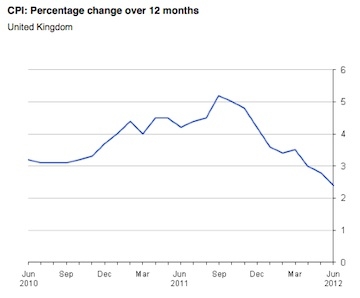

This is the third consecutive month that inflation has fallen and it is now at the lowest rate since November 2009.

The 0.4 per cent fall is the largest fall between May and June since the CPI was launched in 1996.

The largest downward pressures came from clothing and footwear and transport.

Clothing and footwear fell by 4.2 per cent with summer sales starting earlier than usual. Transport fell by 0.5 per cent, most significantly for diesel prices which fell by 4.7 pence per litre and petrol which fell 4.3 pence per litre.

The largest upward pressures came from housing and household services which rose 0.8 per cent, restaurants and hotels which rose 0.4 per cent and food and non-alcoholic beverages which rose 0.3 per cent.

Retail prices index (RPI) inflation, which includes mortgage payments, fell from 3.1 per cent to 2.8 per cent. The largest downward pressures came from motor fuels, food and clothing and footwear.

Leisure goods and housing were the largest upward pressures.

Azad Zangana, European economist at Schroders, said: "The UK's inflation rate is only just beginning to reflect the weakness in the economy. Past increases in taxes have caused a squeeze on household spending power, which in turn is forcing retailers and service providers to scale back price increases.

"Though the sudden fall in the headline rate will raise some concerns over the health of the economy, the ONS has had problems reporting price information when retailers use heavy discounts during the 'sale season'. As a result, this could prove a temporary downward blip in inflation data."

• Want to receive a free weekly summary of the best news stories from our website? Just go to the homepage and submit your name and email

address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.