The retail prices index, which includes mortgage payments, rose from 2.8 per cent to 3.2 per cent.

The increase was against expectations by economists who had expected inflation to fall further to 2.3 per cent.

This was only the second time since 1996 when prices have increased between June and July.

The largest upward pressures came from transport which rose by 1.0 per cent, especially air fares which rose by 21.7 per cent compared with 9.8 per cent a year ago. This was partly offset though by downward contributions from petrol and diesel.

The largest downward contributions came from clothing and footwear which fell by 2.6 per cent and furniture and household goods which fell by 1.1 per cent.

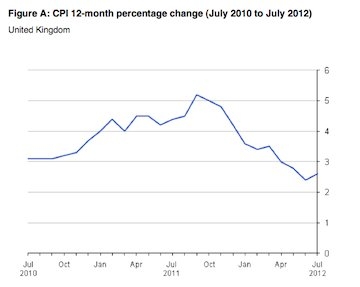

The figures will be bad news for the Bank of England who had been expecting inflation to consistently fall to meet its two per cent target.

Azad Zangana, European economist at Schroders, said: "We are still seeing a downward trend in UK inflation which should eventually help households regain some of their purchasing power in real terms. Nevertheless, the economy is still very fragile and we expect the Bank of England to continue its quantitative easing programme beyond the November end date."

He said the figures had only fallen in the previous month because of the high number of sales starting on the high street.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.