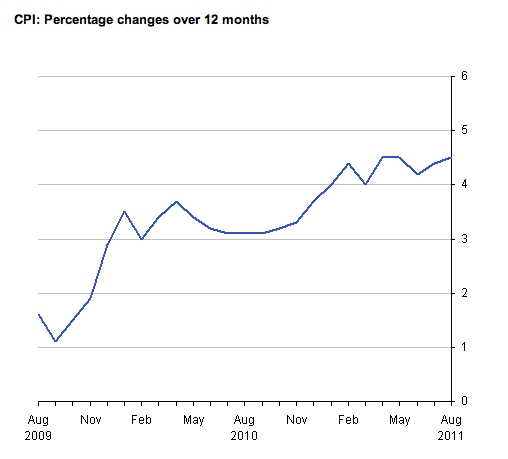

Inflation has increased to 4.5 per cent, up from 4.4 per cent in July, according to the Office of National Statistics.

The Consumer Prices Index inflation is the main measure of inflation while Retail Prices Index inflation increased to 5.2 per cent, up from 5.0 per cent in July.

CPI inflation is now at the highest rate since September 2008.

The main upward pressure came from clothing and footwear, housing and household goods.

Housing, water, electricity and gas prices increased by 5.1 per cent year-on-year, the highest annual increase since July 2009.

Energy prices have increased dramatically recently with British Gas and Scottish Power customers seeing rises of over 18 per cent.

The main downward pressures came from transport, particularly passenger transport by air where airfares were down by 4.9 per cent.

However this was offset by the high price of petrol which rose by 0.9 pence to £1.35 per litre.

There was also downward pressure from recreation and culture where sales of games, toys and hobbies, including computer games and games consoles, dropped by 0.4 per cent. This is the first time since 2005 where there has been a drop in July and August.

Trevor Greetham, portfolio manager of Fidelity’s Multi Asset Funds, said: “At 4.5 per cent, UK headline CPI has hit its highest level since a brief period in the summer of 2008. However, year on year inflation will almost certainly drop back into the Bank of England’s one to three per cent target range in the New Year when the January 2011 hike in VAT drops out of the calculation.”

The next inflation rate figure will be published on 18 October.