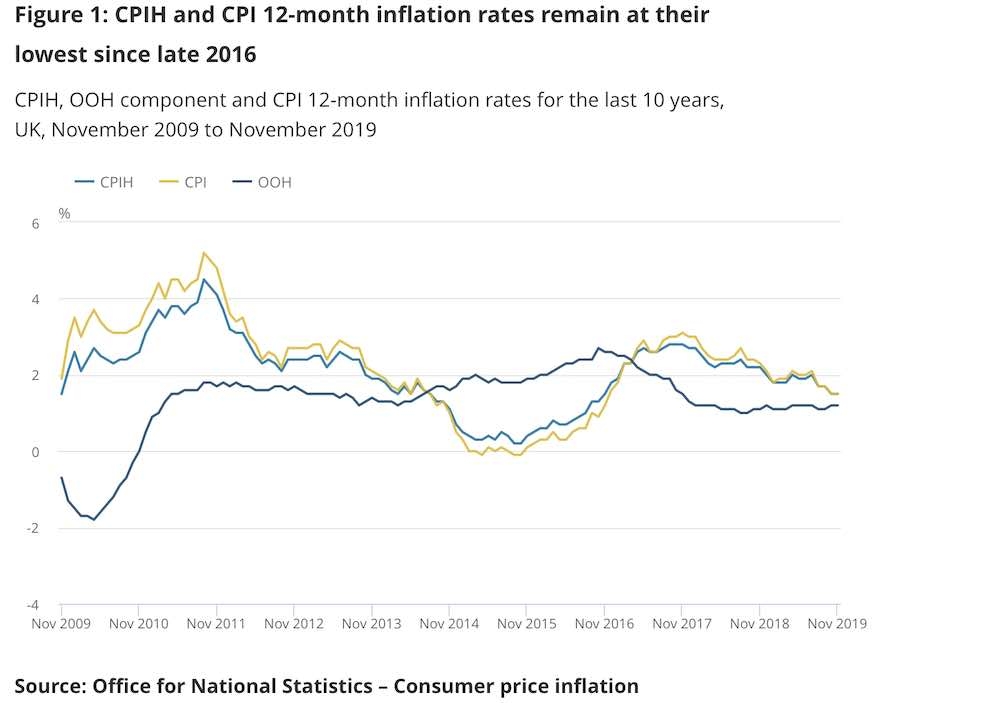

The Consumer Prices Index (CPI) remained at 1.5% in November - a three year low - despite some experts predicting a fall to 1.4%.

The CPI rate including owner occupiers’ housing costs (CPIH) 12-month inflation rate was the same at 1.5% , also unchanged from October 2019.

ONS said the largest contribution to the CPIH 12-month inflation rate in November came from housing, water, electricity, gas and other fuels (+0.36 percentage points).

The largest downward contributions to change came from accommodation services and tobacco.

The largest offsetting upward contributions came from food, and recreation and culture, where prices rose this year by more than a year ago.

Hinesh Patel, portfolio manager at Quilter Investors, said: “It is not surprising to see inflation stubbornly refusing to budge from its current position, well below the Bank of England’s 2% target.

“Our models show that inflation peaked in March of this year and we fully expect it to decelerate a little further in 2020.

“The recent surge in sterling, despite the paring back following Boris Johnson’s commitment to leave the EU by the end of next year, alongside an anticipated and aggressive discounting environment in retail will keep a firm lid on goods inflation.”

Colin Dryburgh, investment manager at Kames Capital, said: “Beyond the prospect of a more stable geopolitical backdrop, the outlook is for strengthening support from fiscal policies – nowhere seemingly more so than in the UK.

“With monetary policy options seen as few and far between, governments are having to shoulder more of the responsibility of promoting growth, regardless of their existing debt position. Low inflation everywhere will – for now - encourage investors to see this as not only safe, but desirable.”