Strong headwinds are making life difficult for the UK economy but what lies ahead? Richard Batty of Standard Life Investments looks at the critical questions for domestic investors, who continue to favour investing in the UK.

The UK economy is being affected by a number of structural growth headwinds which it will find hard to shake-off over the next few years.

De-leveraging by the financial and consumer sectors – two of the strongest contributors to growth in the last cycle - will be one of the biggest growth impediments. A government practising fiscal austerity, worth 1.5 per cent per annum of GDP in the years ahead, will be another. A labour market which, while flexible, has to endure real term wage cuts, is a third.

The net result is a considerable difference between this business cycle and any since the 1930s. The UK economy grew around 2.5 per cent per year in the 10 years to the peak of the last cycle in 2008 with many investors assuming this represented the trend rate of growth. There is good reason to think the potential could fall to 1.5 per cent per annum in the cycle ahead. This is despite the fact the fall in sterling in recent years has provided some support for the export sector, and monetary policy is arguably as loose as at any time in living memory.

What is changing in the economy?

Certainly the economy in 2011 has begun to create more full time opportunities. Nevertheless, one of the key trends within the UK economy which has appeared has been household spending power under intense pressure. Wages have failed to keep up with inflation, meaning that real wages continue to fall. The average hours worked per person is down over 1 per cent in the past year, with more and more people working part-time when they would prefer a full-time job.

However, it is not just this squeeze on incomes that is hitting demand for goods and services – the consumer continues to de-leverage. In the 12 months to end March households repaid £26bn of mortgage debt, the second highest 12-month total since the recession struck. This weakness in consumer spending does seem to be taking some of the sting out of rising prices.

The majority of the MPC continues to vote for no rate change at the Bank of England’s monthly interest rate meeting, believing elevated inflation is largely transitory and that the second round inflation effects are just not coming through - hence wage inflation is likely to remain subdued. One reason for this is that domestic-facing companies are much less robust than foreign customers, while another is that non-consumer facing firms are doing a lot better than those directed at the consumer.

There is also limited feed-through from higher costs to higher prices and few capacity constraints except in some areas of manufacturing and exporting. All in all, these findings are consistent with a sluggish economy, rather than one that is tipping over into recession as some commentators suggest.

Looking ahead, the squeeze on household finances is likely to persist over the remainder of this year, leading to a downward revision to GDP forecasts by many analysts, some of whom are pencilling in a number close to one per cent per annum. Such growth will firmly keep the MPC on hold with regard to interest rates, but it would also ring alarm bells that the government’s austerity measures will not achieve the desired progress in getting the fiscal deficit down.

Volatility in financial markets will also periodically impact on consumer and business sentiment which will negatively affect growth while such conditions persist.

Stock market drivers

The UK stock market is unique among its peer group in that it is 67 per cent exposed to overseas sales, compared to half or less typically among other markets. Such an exposure has been rising steadily over time and means the market is not as impacted by the performance of the domestic economy. Having said this, profits will come under pressure if the global business cycle slows, which we are now seeing in the US, the Eurozone and parts of the emerging markets.

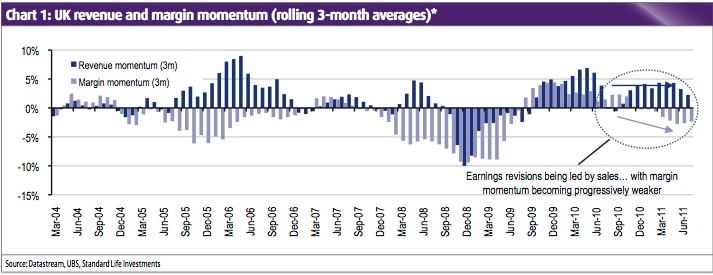

However, we still expect UK profits to grow by 10-15 per cent in this next year or two, despite some margin pressure emerging due to higher input costs. Wages inflation for most companies remains subdued, in line with the wider economy, so this should not be a major drag on margins going forwards. One reason for this robust profits picture is that top line sales continue to remain strong – a key dynamic for the market looking forwards into 2012, as shown in Chart 1. Our company meetings continue to indicate some confidence in the earnings outlook, particularly among corporate-facing businesses on the back of sustained orders. Many industrial companies are now seeing margins back above their 2007/08 peak levels.

However, the guidance from consumer- facing businesses is mixed, with management teams anxious about the combined effects of austerity measures on consumers’ propensity to spend and the impact of inflation on both cost of goods sold and non-discretionary expenditure, putting the squeeze on discretionary spending.

One distinguishing feature of the cycle in the last 12-18 months has been the lacklustre recovery in consumer spending. Measured in real terms, the level of real household spending has increased by less than 1 per cent from the cyclical lows in 2009. This compares with an increase of five-six per cent over the corresponding period in the early 1990s. The high level of personal debt and tight credit environment in part explain this but another feature has been the inflation of non-discretionary household items such as utilities and insurance premiums. These account for a greater proportion of disposable income – currently 66 per cent, having been as low as 56 per cent in 2002.

As a consequence, it has been those businesses at the more discretionary end of the consumer spectrum which are struggling, for example electrical retailing and tour operators. This is leading some to reassess their own levels of capacity in the market. Examples include continued speculation of the closure of Comet stores, Mothercare reducing its UK store footprint, non- quoted Focus Do-It-All stores in the hands of the administrators and tour operators again cutting capacity in the UK holiday market.

Those consumer stocks which are making progress, despite the subdued consumer backdrop, tend to be in sub-sectors where there has already been action on capacity as the market was in decline prior to the onset of the financial crisis, that is the pubs and home improvement markets (Kingfisher – B&Q, Howden Joinery). For the banking sector the improvement in net interest margins has slowed of late as asset margin improvement has largely played through from fixed mortgages rolling onto standard variable rates and liability margins capped by competition for deposits.

But the bigger issue for UK banks remains regulation, with a real concern that the UK’s over-zealous approach – “super equivalence” - will force higher capital ratios and lower return on equity relative to US and EU peers. One negative for banks profits is the state of the economy’s credit conditions. Lending and housing market data remains weak with mortgage credit figures just 10-20 per cent of the level achieved before the financial crisis. This reinforces the market’s concerns over the effectiveness of the monetary transmission mechanism and the self- sustaining nature of the recovery, despite loose monetary policy. The conundrum remains how lending can pick up from a starting point of high consumer indebtedness, especially in the context of the reform of the global banking system, one that is likely to lead to increased capital requirements or reduced risk weighted assets.

What expectations are priced in?

The rise in uncertainty in the global economy driven by sovereign debt concerns has caused a dramatic fall in equities this summer. Valuations are starting to look compelling on a medium term basis as a major global slowdown now appears to be priced into the asset class. As an example the earning yield on the FTSE All Share is 10 per cent while the government bond yield is around 2.5 per cent, the highest yield gap (apart from brief periods in 2009 and 1974) since 1958. The UK market trades in PE terms on 9x CY11 EPS. For CY11 and CY12, consensus earnings expectations are for a sharp rebound (+18 per cent and +9 per cent), although this is distorted by a tail of sectors seeing sharp rebounds – hence earnings growth (ex resources) is forecast at +13 per cent in CY11. Free cashflow yield is forecast at 6.4 per cent for CY11, a record, while the dividend yield is 3.8 per cent for CY11, based on the consensus forecast of +18 per cent dividend growth as earnings recover and BP re-starts its dividend payments. Excluding the resources sector, dividend growth is solid, if only forecast at 10 per cent. UK corporates now face the luxury problem of what to do with their cash.

What is the longer term outlook?

Given the value now emerging in the UK equity market, what triggers are needed to crystallise this? With investors focused on sovereign debt issues overseas, a clear policy response by the global authorities to the fiscal crisis would be welcome. The recent ECB intervention to buy Italian and Spanish government debt is a helpful start but more policy initiatives are needed, including a commitment to eventual fiscal union within the Eurozone.

Further quantitative easing (QE) in say the US, would also be very helpful for equities as some of this money will ‘leak’ out into the wider economy. If emerging markets halt, or even reverse, their recent monetary policy tightening, this would help ensure continued strong economic growth in that part of the world. This would mean one of the chief engines of UK stock market profits growth remains intact. Finally, the recent fall in oil prices will help reduce the energy bills of cash strapped consumers, freeing up more money for discretionary spending.

Additionally, within the market there will remain a focus on the outlook for earnings, in particular the comments made in company guidance. The market will gauge to what extent earnings are being driven by top line versus cost cutting. Industrial and mining stocks will continue to be driven by expectations over the sustainability of industrial activity, particularly in the US and China. The market will remain focused on the health of the largest economies until fears of recession have receded. This will be challenging in the context of high unemployment, restricted credit availability, static wages and inflation pressures. Similar problems face the UK consumer. The market will also monitor monetary conditions (seen in an improvement in broad money indicators potentially boosted by a restart of QE), in particular banks’ propensity to lend in the context of capital adequacy proposals.