The economic gloom may be masking some significant investment opportunities during the UK's Olympic year. Sally Hamilton talks to some leading planners and other experts about what lies ahead.

In most aspects of life, it is a good idea to fit in with other people’s feelings. If you are at a birthday party, it is sensible to wear a smile, at a funeral, it is tactful to show a look of mourning. But these social norms do not apply in investment, where an ability to ignore the mood around you can sometimes pay off handsomely.

To take two recent examples, 1999 ended in a huge wave of optimism, yet the investor who had started the New Year in a pessimistic mood might have avoided a painful three-year bear market. And 2008 ended in a mood of despair, yet the investor who was bold enough to buy then would have enjoyed the fruits of the powerful rally that started in April 2009.

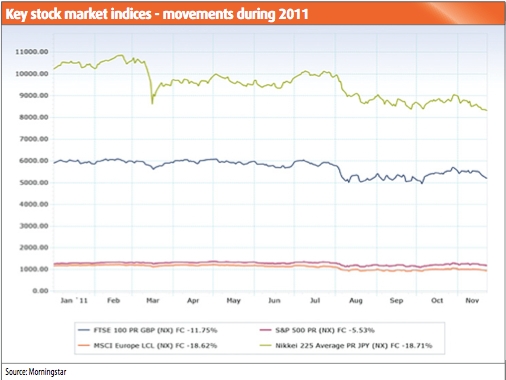

The period 2011-2012 could be another case in point. The old year is drawing to a close amid jitters over the future of the euro area, possible default by Greece, political deadlock in the US and rising unemployment in the UK.

The question facing investors is not whether there are reasons to worry - there are - but whether those worries are already priced into the stock market. If they are, then it could be that 2012 will be a better year for equities than most people expect.

Here are some possible reasons why - the Bank of England and the US Federal Reserve are printing money to support their economies, and some of that cash may reach equities; shares are looking good value compared to UK, US and German government bonds; inflation is likely to fall sharply in Britain next year as indirect tax rises and energy price hikes drop out of the calculations; and our economy should get a big summer boost from the Olympic Games.

As usual, the experts are well and truly split between those that believe the worst of the various crises of late 2011 are yet to come - and those who see some of those rays of light on the horizon for the New Year. And there are those that choose to ignore the “noise” and disruption and keep their eyes firmly on the Financial Planning road ahead.

Justin Urquhart Stewart of investment provider 7IM is taking an optimistic approach for the coming year. He said: “I am pretty bullish. The global economy is still growing. It may be low and slower but it’s not in such bad shape. The markets have been hideously underperforming not because of the markets but because of a lack of credible leadership over the euro and the US economy. Meanwhile corporate growth has been good.” He also believes China, whose economy has been battered of late, will revive as it tries to get its economy growing again. Mr Urquhart Stewart even has optimistic thoughts about Europe”s prospects. He said: “Something will occur to strengthen the euro so long as the politicians make credible decisions.”

Mr Urquhart Stewart stresses the need for careful asset allocation, however. He said: “This should include corporates paying dividends and high-grade corporate bonds - sovereign debt will remain unpleasant. Avoid commodities as they have reached a peak. You can also get good exposure to markets like China through big UK listed companies. The likes of Siemens, Unilever and Nestle will give you that for healthcare and food while at the top end there are companies like Diageo.”

Tom Stevenson, investment director at Fidelity, also sees continuing value for UK bluechips that pay good yields but is cautious about the coming year. He said: “Quite a few companies are paying 5 per cent yields, which is attractive when you compare them to what you get from cash on deposit but I’m cautious about 2012, however. It feels like a re-run of 2007-2008. We could hit bottom and begin to recover. It’s important not to focus too intently on what’s going on in Europe and look at the US where the results season showed there it is clearly in recovery, albeit it at a slow pace.”

He also believes the Far East offers certain appeal, at least for a small portion of a portfolio. He said: “There has been a pullback in growth in Asian markets but there is an underlying strength in these economies where they are not saddled with debt problems.”

Mr Stevenson believes next year might be a time to start thinking about protecting portfolios against the return of inflation, as the long-term solution to the debt problems in Europe is likely to be to continue to be to inflate away the value of the debt. He said: “In the short-term the only sensible approach is to have multiple assets. But equities look more attractive than bonds.”

The Olympics may cause a flurry of excitement for sports fans and investors next summer but Mr Stevenson feels the economic advantages and disadvantages may just cancel each other out. He said: “The Olympics will be irrelevant in global terms. And if people decide to work at home during the event it could have a negative impact on the UK economy but then the positive economic impact of visitors coming to the games could rebalance that.”

Danny Cox CFPCM, head of advice at investment group Hargreaves Lansdown, sayid UK companies might feel a “halo” effect from the games for a while and get a short-term boost in revenues but that it could be fleeting. Bigger issues will be at play, he believes, as the markets continue to deal with the influence of the big issues of 2011. He said: “2011 has been completely dominated by the eurozone crisis. The gold price was at record highs as investors made their flight to safety. Gilts are a bed of nitroglycerine. Their yields are down which has affected annuities, not least because of quantitative easing.”

One place offering value in his opinion is Japan, following the financial fallout from the earthquake and tsunami in spring 2011, says Mr Cox. He said: “Japan could have a good year in 2012. While they have a huge amount of debt it is owed to themselves and not third parties.” He also feels emerging markets, while having come off the boil lately, will revive. He said: “There will be a rough ride but they will deliver good returns again.”

Brian Dennehy CFPCM of Dennehy Weller is wary of going far afield and is generally cautious about 2012. He said: “Be wary of China. I also think Eastern Europe could get particularly ugly with banks withdrawing funding. Hungary is already going cap in hand to the IMF and there will be more to follow.” He prefers to stick to high quality bonds and certain absolute return funds. Mr Dennehy said: “Avoid everything else. I exaggerate but you get how I’m feeling.”

Mr Dennehy is sceptical of views that current concerns are already priced into the markets. He said: “Talk is cheap; stock markets aren’t. Cheap is at least 20 per cent below where we are in the UK and Europe and globally.”

Mr Cox feels more optimistic and believes equity income will be an attractive story in 2012. He said: “If you only buy one fund I would invest in equity income. Neil Woodford’s Perpetual High Income fund focuses on the long term and he ignores what’s going on around him. He avoided the banks, which has cost him in the past but over the last six months the banks have gone backwards while he’s done well. His fund is full of defensive stocks such as Glaxo and BAT, which have been delivering good yields. Equity income is good core holding because if the share value falls then the dividends coming in can prop up their performance.”

He is cautious about investment grade bonds and gilts for 2012 and beyond, which he says will be hit hard if and when interest rates are raised in a bid to help control inflation, even though he believes interest rates may well remain at their current level throughout 2012.

Mr Cox prefers strategic bond funds, because of their ability to invest in many types of bond and move from one type to another, depending on prevailing opportunities or risks. He said: “These allow the fund manager to make the call rather than keep to the rules of a straightforward corporate bond fund.”

He added: “We’re going into the fifth year of low interest rates and we could have two, three or four more years of this. Markets will be tricky. This makes Financial Planning and tax planning even more important. If clients are fulfilling their Isa allowances every year, when the recovery does happen the growth will all be tax-free. Our role is to show them how to take profits when profits are low. Perhaps it is time to get out of a with profits bond or a structured product and reinvest it in something that will recover at a better rate. 2012 will be a good year for Financial Planning.”

Next year will certainly be bumpy, suggests Caspar Rock, chief executive officer of Architas, the multi-manager fund group, which is part of AXA, with investors having to deal with a scenario of “risk on-risk off in the developed markets.” He feels optimistic about progress in the emerging markets, however, which have recently been hit by developments in the Middle East and worries over the Bric economies of Brazil and China overheating as their inflation rates have spiralled.

Mr Rock said: “There is so much noise to deal with. Given that backdrop I do think Asia and the emerging markets will do better. “At home, where he also believes interest rates will remain low for several years to come, he is backing the blue chips. He said: “Larger cap companies will do well in 2012 as will large exporters. Income shares will continue to be attractive.” On fixed interest, Mr Rock tips convertible bonds. He said: “They are a nice hedge. If things go really badly they shouldn’t fall and if they recover, they will recover too.”

Inflation will be lower, but for mechanical reasons, he suggests. Mr Rock said: “The impact of commodity and oil price rises will roll off over the coming months as will the rise of VAT. Inflation will fall next year.”

Michael Owen CFPCM of advisers Brooks Macdonald says that however nervous investors might be they should be wary of certain cash options. He said: “Don’t be tempted by long-term savings bond accounts. You don’t want to be tied into something that will look poor value in a year’s time.” He also likes high- income funds, suggesting “even if the market doesn’t go anywhere next year you will get quite a decent dividend yield.”

Many planners prefer to push ahead with Financial Planning without direct reference to any upheaval and will continue to do so in 2012. Among them is Shane Mullins of Fiscal Engineers (see On The Spot p14). He said: “We take the long term view and believe making short-term tactical bets is a dangerous thing to do. Staying in your seat is not to be underestimated. We think that activity can often inflict the most damage on a portfolio. The vast majority of active managers don’t get the market return. That’s why we are 100 per cent in trackers with very low turnover rates and low TERs. We have model portfolios that we build for individual investors.He added: “By many indications the UK market looks like good value. The question is will it give good value in the next few months?” Mr Owen believes it is in the hands of northern European leaders and to some extent the US. He said: “They have tough decisions to take between political expediency and long- term economic good.”

“We are not trying to time the market. I do not pay attention to short-term market noise. It’s not helpful when the TV news announces that the market has closed down a few points and suggests it’s Armageddon. Markets are noisy and volatile and yes earnings may slow but the world hasn’t changed so fundamentally. You’ve got to have a fairly positive outlook. Things do turn around. It’s a case of hang on to your hats.”

Lee Dunn CFPCM of Paradigm Norton Financial Planning takes a similar approach. He said: “Clients often ask me where the markets are going in the next month, six months, year. My answer is always the same – I have absolutely no idea, short-term market movements are completely and utterly random. We have a single strategy for dealing with the complete uncertainty of markets in the short term. We determine the most suitable strategy for the client. This is influenced by two factors: risk tolerance and the investment returns needed to achieve the client’s articulated life goals. We then stick to the strategy through thick and thin, rebalancing periodically back to the agreed strategy. That’s it.”

For 2012, his firm will not be making reactive changes. He said: “Our investment strategy is the same for all seasons – we’re in the long term ‘buy and hold’ camp. We do strategic asset allocation and we rebalance periodically. We don’t do tactical because we believe markets are mostly efficient. Even on the rare occasions when prices are crazy you’ll inevitably get the timing wrong. I suspect we may be in the minority here in not attempting tactical asset allocation. We don’t play the game of trying to beat the markets because history shows it’s a game with a low probability of success – a few winners but mostly losers.”